We are still in an overall bull market and many stocks that smart money investors were piling into surged through October 17th. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 45% and 39% respectively. Hedge funds’ top 3 stock picks returned 34.4% this year and beat the S&P 500 ETFs by 13 percentage points. Investing in index funds guarantees you average returns, not superior returns. We are looking to generate superior returns for our readers. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Concrete Pumping Holdings, Inc. (NASDAQ:BBCP).

Concrete Pumping Holdings, Inc. (NASDAQ:BBCP) investors should be aware of an increase in enthusiasm from smart money of late. Our calculations also showed that BBCP isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

In addition to following the biggest hedge funds for investment ideas, we also share stock pitches from conferences, investor letters and other sources like this one where the fund manager is talking about two under the radar 1000% return potential stocks: first one in internet infrastructure and the second in the heart of advertising market. We use hedge fund buy/sell signals to determine whether to conduct in-depth analysis of these stock ideas which take days. Let’s review the fresh hedge fund action regarding Concrete Pumping Holdings, Inc. (NASDAQ:BBCP).

How are hedge funds trading Concrete Pumping Holdings, Inc. (NASDAQ:BBCP)?

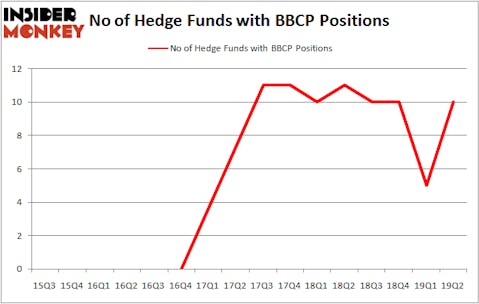

At Q2’s end, a total of 10 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 100% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards BBCP over the last 16 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Richard S. Meisenberg’s ACK Asset Management has the number one position in Concrete Pumping Holdings, Inc. (NASDAQ:BBCP), worth close to $23.3 million, corresponding to 6.8% of its total 13F portfolio. The second largest stake is held by Owl Creek Asset Management, led by Jeffrey Altman, holding a $16.4 million position; 0.5% of its 13F portfolio is allocated to the stock. Other members of the smart money that are bullish consist of Glenn Russell Dubin’s Highbridge Capital Management, Joseph Samuels’s Islet Management and Richard Driehaus’s Driehaus Capital.

As one would reasonably expect, some big names have jumped into Concrete Pumping Holdings, Inc. (NASDAQ:BBCP) headfirst. ACK Asset Management, managed by Richard S. Meisenberg, established the most valuable position in Concrete Pumping Holdings, Inc. (NASDAQ:BBCP). ACK Asset Management had $23.3 million invested in the company at the end of the quarter. Glenn Russell Dubin’s Highbridge Capital Management also made a $6.2 million investment in the stock during the quarter. The following funds were also among the new BBCP investors: Joseph Samuels’s Islet Management, Richard Driehaus’s Driehaus Capital, and Anand Parekh’s Alyeska Investment Group.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Concrete Pumping Holdings, Inc. (NASDAQ:BBCP) but similarly valued. We will take a look at Cumulus Media Inc (NASDAQ:CMLS), Legacy Housing Corporation (NASDAQ:LEGH), Regional Management Corp (NYSE:RM), and Limelight Networks, Inc. (NASDAQ:LLNW). This group of stocks’ market valuations match BBCP’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CMLS | 9 | 117968 | -4 |

| LEGH | 3 | 675 | -4 |

| RM | 11 | 68103 | -2 |

| LLNW | 11 | 34264 | -1 |

| Average | 8.5 | 55253 | -2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.5 hedge funds with bullish positions and the average amount invested in these stocks was $55 million. That figure was $58 million in BBCP’s case. Regional Management Corp (NYSE:RM) is the most popular stock in this table. On the other hand Legacy Housing Corporation (NASDAQ:LEGH) is the least popular one with only 3 bullish hedge fund positions. Concrete Pumping Holdings, Inc. (NASDAQ:BBCP) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately BBCP wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on BBCP were disappointed as the stock returned -22.5% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.