The elite funds run by legendary investors such as David Tepper and Dan Loeb make hundreds of millions of dollars for themselves and their investors by spending enormous resources doing research on small cap stocks that big investment banks don’t follow. Because of their pay structures, they have strong incentives to do the research necessary to beat the market. That’s why we pay close attention to what they think in small cap stocks. In this article, we take a closer look at CIT Group Inc. (NYSE:CIT) from the perspective of those elite funds.

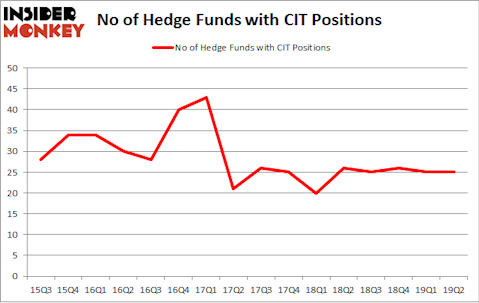

CIT Group Inc. (NYSE:CIT) shares haven’t seen a lot of action during the second quarter. Overall, hedge fund sentiment was unchanged. The stock was in 25 hedge funds’ portfolios at the end of June. At the end of this article we will also compare CIT to other stocks including EnLink Midstream LLC (NYSE:ENLC), Choice Hotels International, Inc. (NYSE:CHH), and Eaton Vance Corp (NYSE:EV) to get a better sense of its popularity.

At the moment there are several metrics shareholders can use to grade stocks. A couple of the most useful metrics are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the top picks of the elite investment managers can outpace the S&P 500 by a solid amount (see the details here).

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a look at the recent hedge fund action surrounding CIT Group Inc. (NYSE:CIT).

How are hedge funds trading CIT Group Inc. (NYSE:CIT)?

At the end of the second quarter, a total of 25 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the first quarter of 2019. Below, you can check out the change in hedge fund sentiment towards CIT over the last 16 quarters. With the smart money’s capital changing hands, there exists a few notable hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

More specifically, First Pacific Advisors LLC was the largest shareholder of CIT Group Inc. (NYSE:CIT), with a stake worth $462.3 million reported as of the end of March. Trailing First Pacific Advisors LLC was Lakewood Capital Management, which amassed a stake valued at $124.1 million. Owl Creek Asset Management, Millennium Management, and Renaissance Technologies were also very fond of the stock, giving the stock large weights in their portfolios.

Seeing as CIT Group Inc. (NYSE:CIT) has witnessed declining sentiment from the entirety of the hedge funds we track, we can see that there were a few money managers that decided to sell off their full holdings heading into Q3. At the top of the heap, Ravi Chopra’s Azora Capital dropped the biggest investment of the 750 funds tracked by Insider Monkey, totaling an estimated $20.7 million in stock, and George Soros’s Soros Fund Management was right behind this move, as the fund said goodbye to about $4.4 million worth. These transactions are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks similar to CIT Group Inc. (NYSE:CIT). We will take a look at EnLink Midstream LLC (NYSE:ENLC), Choice Hotels International, Inc. (NYSE:CHH), Eaton Vance Corp (NYSE:EV), and BWX Technologies Inc (NYSE:BWXT). This group of stocks’ market values match CIT’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ENLC | 12 | 39620 | 2 |

| CHH | 19 | 193292 | 1 |

| EV | 15 | 97050 | 2 |

| BWXT | 19 | 105875 | 1 |

| Average | 16.25 | 108959 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.25 hedge funds with bullish positions and the average amount invested in these stocks was $109 million. That figure was $879 million in CIT’s case. Choice Hotels International, Inc. (NYSE:CHH) is the most popular stock in this table. On the other hand EnLink Midstream LLC (NYSE:ENLC) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks CIT Group Inc. (NYSE:CIT) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately CIT wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on CIT were disappointed as the stock returned -13.1% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks (view the video below) among hedge funds as many of these stocks already outperformed the market in Q3.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.