A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended September 30th, so let’s proceed with the discussion of the hedge fund sentiment on Bottomline Technologies, Inc. (NASDAQ:EPAY).

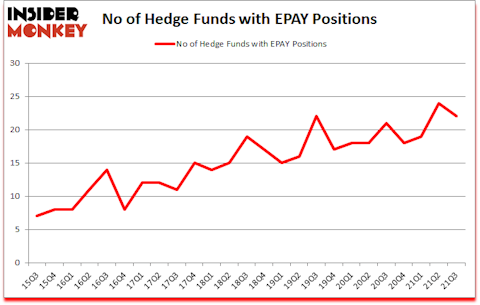

Bottomline Technologies, Inc. (NASDAQ:EPAY) has experienced a decrease in activity from the world’s largest hedge funds lately. Bottomline Technologies, Inc. (NASDAQ:EPAY) was in 22 hedge funds’ portfolios at the end of the third quarter of 2021. The all time high for this statistic is 24. Our calculations also showed that EPAY isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Now let’s take a gander at the new hedge fund action surrounding Bottomline Technologies, Inc. (NASDAQ:EPAY).

Do Hedge Funds Think EPAY Is A Good Stock To Buy Now?

At the end of September, a total of 22 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -8% from the second quarter of 2021. On the other hand, there were a total of 21 hedge funds with a bullish position in EPAY a year ago. With hedgies’ capital changing hands, there exists a select group of key hedge fund managers who were adding to their holdings substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Scott Ferguson’s Sachem Head Capital has the largest position in Bottomline Technologies, Inc. (NASDAQ:EPAY), worth close to $67.8 million, accounting for 1.7% of its total 13F portfolio. Coming in second is Hawk Ridge Management, managed by David Brown, which holds a $45.2 million position; 2.9% of its 13F portfolio is allocated to the stock. Other members of the smart money that are bullish encompass Richard Merage’s MIG Capital, Marc Majzner’s Clearline Capital and Greg Poole’s Echo Street Capital Management. In terms of the portfolio weights assigned to each position Clearfield Capital allocated the biggest weight to Bottomline Technologies, Inc. (NASDAQ:EPAY), around 4.28% of its 13F portfolio. MIG Capital is also relatively very bullish on the stock, setting aside 3.92 percent of its 13F equity portfolio to EPAY.

Since Bottomline Technologies, Inc. (NASDAQ:EPAY) has faced declining sentiment from the smart money, it’s safe to say that there was a specific group of hedgies who sold off their positions entirely in the third quarter. At the top of the heap, Noam Gottesman’s GLG Partners said goodbye to the largest investment of all the hedgies monitored by Insider Monkey, worth close to $5.1 million in stock. Greg Eisner’s fund, Engineers Gate Manager, also cut its stock, about $1.4 million worth. These moves are intriguing to say the least, as total hedge fund interest fell by 2 funds in the third quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Bottomline Technologies, Inc. (NASDAQ:EPAY). We will take a look at Regenxbio Inc (NASDAQ:RGNX), Crestwood Equity Partners LP (NYSE:CEQP), Taboola.com Ltd. (NASDAQ:TBLA), Eventbrite, Inc. (NYSE:EB), The Bank of N.T. Butterfield & Son Limited (NYSE:NTB), Sumo Logic, Inc. (NASDAQ:SUMO), and Hope Bancorp, Inc. (NASDAQ:HOPE). All of these stocks’ market caps resemble EPAY’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RGNX | 15 | 185354 | 0 |

| CEQP | 3 | 4405 | -4 |

| TBLA | 18 | 63121 | 18 |

| EB | 17 | 306027 | -8 |

| NTB | 16 | 87402 | -1 |

| SUMO | 15 | 111223 | 2 |

| HOPE | 14 | 82607 | -2 |

| Average | 14 | 120020 | 0.7 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14 hedge funds with bullish positions and the average amount invested in these stocks was $120 million. That figure was $236 million in EPAY’s case. Taboola.com Ltd. (NASDAQ:TBLA) is the most popular stock in this table. On the other hand Crestwood Equity Partners LP (NYSE:CEQP) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks Bottomline Technologies, Inc. (NASDAQ:EPAY) is more popular among hedge funds. Our overall hedge fund sentiment score for EPAY is 80.5. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks returned 29.6% in 2021 and managed to beat the market by 3.6 percentage points. Hedge funds were also right about betting on EPAY as the stock returned 43.8% since the end of September (through 12/31) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Empresa Nacional De Elect Chile (NYSE:EOC)

Follow Empresa Nacional De Elect Chile (NYSE:EOC)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Best High Dividend Stocks to Buy

- Top 15 Pharmaceutical Companies With Highest R&D Spending

- 12 Best MLP and Pipeline Stocks To Buy

Disclosure: None. This article was originally published at Insider Monkey.