You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund managers like Jeff Ubben, George Soros and Seth Klarman hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

Array Biopharma Inc (NASDAQ:ARRY) has seen an increase in support from the world’s most elite money managers of late. Our calculations also showed that ARRY isn’t among the 30 most popular stocks among hedge funds.

According to most market participants, hedge funds are viewed as worthless, outdated investment vehicles of the past. While there are over 8000 funds with their doors open at present, Our researchers look at the masters of this club, approximately 750 funds. These investment experts handle the majority of the hedge fund industry’s total capital, and by tailing their inimitable equity investments, Insider Monkey has deciphered numerous investment strategies that have historically beaten the market. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by around 5 percentage points per annum since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

Let’s go over the recent hedge fund action surrounding Array Biopharma Inc (NASDAQ:ARRY).

How have hedgies been trading Array Biopharma Inc (NASDAQ:ARRY)?

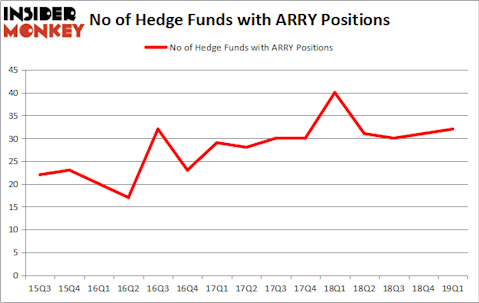

At the end of the first quarter, a total of 32 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 3% from one quarter earlier. On the other hand, there were a total of 40 hedge funds with a bullish position in ARRY a year ago. With the smart money’s capital changing hands, there exists a select group of notable hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

Among these funds, Redmile Group held the most valuable stake in Array Biopharma Inc (NASDAQ:ARRY), which was worth $267.5 million at the end of the first quarter. On the second spot was Farallon Capital which amassed $134.1 million worth of shares. Moreover, Perceptive Advisors, Baker Bros. Advisors, and Biotechnology Value Fund / BVF Inc were also bullish on Array Biopharma Inc (NASDAQ:ARRY), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, specific money managers were breaking ground themselves. Perceptive Advisors, managed by Joseph Edelman, assembled the biggest position in Array Biopharma Inc (NASDAQ:ARRY). Perceptive Advisors had $103.1 million invested in the company at the end of the quarter. Behzad Aghazadeh’s venBio Select Advisor also made a $48.8 million investment in the stock during the quarter. The other funds with brand new ARRY positions are Jim Simons’s Renaissance Technologies, Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital, and Jeffrey Jay and David Kroin’s Great Point Partners.

Let’s now take a look at hedge fund activity in other stocks similar to Array Biopharma Inc (NASDAQ:ARRY). We will take a look at Transocean Ltd (NYSE:RIG), Hudson Pacific Properties Inc (NYSE:HPP), Lincoln Electric Holdings, Inc. (NASDAQ:LECO), and EQT Corporation (NYSE:EQT). This group of stocks’ market valuations match ARRY’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RIG | 37 | 756782 | 4 |

| HPP | 12 | 362610 | 0 |

| LECO | 26 | 308752 | 7 |

| EQT | 36 | 1181332 | -8 |

| Average | 27.75 | 652369 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27.75 hedge funds with bullish positions and the average amount invested in these stocks was $652 million. That figure was $1107 million in ARRY’s case. Transocean Ltd (NYSE:RIG) is the most popular stock in this table. On the other hand Hudson Pacific Properties Inc (NYSE:HPP) is the least popular one with only 12 bullish hedge fund positions. Array Biopharma Inc (NASDAQ:ARRY) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on ARRY as the stock returned 11.8% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.