Investing in small cap stocks has historically been a way to outperform the market, as small cap companies typically grow faster on average than the blue chips. That outperformance comes with a price, however, as there are occasional periods of higher volatility. The fourth quarter of 2018 is one of those periods, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by nearly 7 percentage points. Given that the funds we track tend to have a disproportionate amount of their portfolios in smaller cap stocks, they have seen some volatility in their portfolios too. Actually their moves are potentially one of the factors that contributed to this volatility. In this article, we use our extensive database of hedge fund holdings to find out what the smart money thinks of Apache Corporation (NYSE:APA).

Apache Corporation (NYSE:APA) investors should be aware of an increase in support from the world’s most elite money managers recently. Our calculations also showed that APA isn’t among the 30 most popular stocks among hedge funds.

To most stock holders, hedge funds are assumed to be worthless, outdated investment vehicles of the past. While there are greater than 8000 funds with their doors open at the moment, Our researchers choose to focus on the crème de la crème of this group, approximately 750 funds. Most estimates calculate that this group of people handle the majority of all hedge funds’ total asset base, and by keeping an eye on their finest equity investments, Insider Monkey has deciphered a number of investment strategies that have historically outrun the S&P 500 index. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by nearly 5 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s analyze the fresh hedge fund action encompassing Apache Corporation (NYSE:APA).

How are hedge funds trading Apache Corporation (NYSE:APA)?

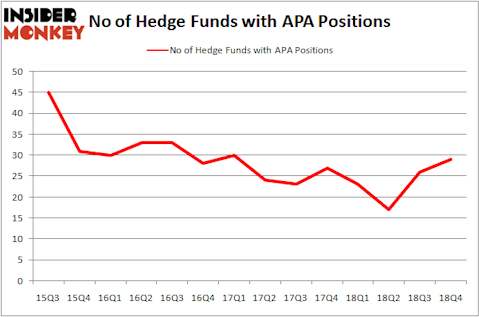

At Q4’s end, a total of 29 of the hedge funds tracked by Insider Monkey were long this stock, a change of 12% from the previous quarter. The graph below displays the number of hedge funds with bullish position in APA over the last 14 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

The largest stake in Apache Corporation (NYSE:APA) was held by Orbis Investment Management, which reported holding $355.1 million worth of stock at the end of September. It was followed by Point72 Asset Management with a $26.8 million position. Other investors bullish on the company included Two Sigma Advisors, Citadel Investment Group, and GLG Partners.

As industrywide interest jumped, key money managers have jumped into Apache Corporation (NYSE:APA) headfirst. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, initiated the biggest position in Apache Corporation (NYSE:APA). Arrowstreet Capital had $5.1 million invested in the company at the end of the quarter. Karim Abbadi and Edward McBride’s Centiva Capital also made a $1.3 million investment in the stock during the quarter. The other funds with brand new APA positions are Dmitry Balyasny’s Balyasny Asset Management, Peter Algert and Kevin Coldiron’s Algert Coldiron Investors, and Mike Vranos’s Ellington.

Let’s now take a look at hedge fund activity in other stocks similar to Apache Corporation (NYSE:APA). We will take a look at FMC Corporation (NYSE:FMC), Akamai Technologies, Inc. (NASDAQ:AKAM), Regency Centers Corp (NASDAQ:REG), and Campbell Soup Company (NYSE:CPB). This group of stocks’ market caps are similar to APA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FMC | 32 | 1377346 | -5 |

| AKAM | 34 | 902737 | 5 |

| REG | 15 | 301496 | -3 |

| CPB | 29 | 816874 | 0 |

| Average | 27.5 | 849613 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27.5 hedge funds with bullish positions and the average amount invested in these stocks was $850 million. That figure was $475 million in APA’s case. Akamai Technologies, Inc. (NASDAQ:AKAM) is the most popular stock in this table. On the other hand Regency Centers Corp (NASDAQ:REG) is the least popular one with only 15 bullish hedge fund positions. Apache Corporation (NYSE:APA) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on APA as the stock returned 32.3% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.