While the market driven by short-term sentiment influenced by the accommodative interest rate environment in the US, increasing oil prices and deteriorating expectations towards the resolution of the trade war with China, many smart money investors kept their cautious approach regarding the current bull run in the third quarter and hedging or reducing many of their long positions. Some fund managers are betting on Dow hitting 40,000 to generate strong returns. However, as we know, big investors usually buy stocks with strong fundamentals that can deliver gains both in bull and bear markets, which is why we believe we can profit from imitating them. In this article, we are going to take a look at the smart money sentiment surrounding Antares Pharma Inc (NASDAQ:ATRS).

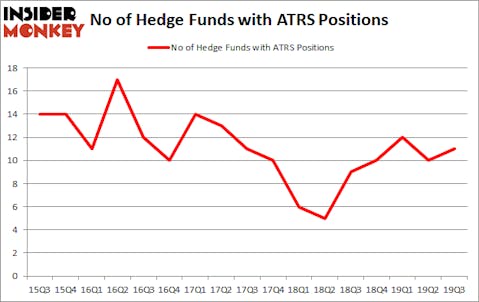

Antares Pharma Inc (NASDAQ:ATRS) shareholders have witnessed an increase in hedge fund sentiment in recent months. ATRS was in 11 hedge funds’ portfolios at the end of the third quarter of 2019. There were 10 hedge funds in our database with ATRS holdings at the end of the previous quarter. Our calculations also showed that ATRS isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.8% through November 21, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Kevin Kotler of Broadfin Capital

We leave no stone unturned when looking for the next great investment idea. For example, Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. We’re going to check out the new hedge fund action regarding Antares Pharma Inc (NASDAQ:ATRS).

Hedge fund activity in Antares Pharma Inc (NASDAQ:ATRS)

At Q3’s end, a total of 11 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 10% from one quarter earlier. On the other hand, there were a total of 9 hedge funds with a bullish position in ATRS a year ago. With hedgies’ capital changing hands, there exist a few notable hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

The largest stake in Antares Pharma Inc (NASDAQ:ATRS) was held by Armistice Capital, which reported holding $18.8 million worth of stock at the end of September. It was followed by Broadfin Capital with a $4.5 million position. Other investors bullish on the company included Two Sigma Advisors, Marshall Wace, and Healthcare Value Capital. In terms of the portfolio weights assigned to each position Armistice Capital allocated the biggest weight to Antares Pharma Inc (NASDAQ:ATRS), around 1.25% of its 13F portfolio. Healthcare Value Capital is also relatively very bullish on the stock, dishing out 1.21 percent of its 13F equity portfolio to ATRS.

As industrywide interest jumped, some big names have been driving this bullishness. Healthcare Value Capital, managed by Joe Riccardo, created the biggest position in Antares Pharma Inc (NASDAQ:ATRS). Healthcare Value Capital had $0.7 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also made a $0 million investment in the stock during the quarter. The only other fund with a brand new ATRS position is Donald Sussman’s Paloma Partners.

Let’s also examine hedge fund activity in other stocks similar to Antares Pharma Inc (NASDAQ:ATRS). We will take a look at Peapack-Gladstone Financial Corp (NASDAQ:PGC), Ichor Holdings (NASDAQ:ICHR), ADTRAN, Inc. (NASDAQ:ADTN), and Resources Connection, Inc. (NASDAQ:RECN). All of these stocks’ market caps are similar to ATRS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PGC | 16 | 59858 | 1 |

| ICHR | 8 | 53884 | 0 |

| ADTN | 15 | 64970 | 2 |

| RECN | 17 | 54217 | 4 |

| Average | 14 | 58232 | 1.75 |

View the table here if you experience formatting issues.

As you can see these stocks had an average of 14 hedge funds with bullish positions and the average amount invested in these stocks was $58 million. That figure was $28 million in ATRS’s case. Resources Connection, Inc. (NASDAQ:RECN) is the most popular stock in this table. On the other hand Ichor Holdings (NASDAQ:ICHR) is the least popular one with only 8 bullish hedge fund positions. Antares Pharma Inc (NASDAQ:ATRS) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on ATRS as the stock returned 41.2% during the first two months of Q4 and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.