“The global economic environment is very favorable for investors. Economies are generally strong, but not too strong. Employment levels are among the strongest for many decades. Interest rates are paused at very low levels, and the risk of significant increases in the medium term seems low. Financing for transactions is freely available to good borrowers, but not in major excess. Covenants are lighter than they were five years ago, but the extreme excesses seen in the past do not seem prevalent yet today. Despite this apparent ‘goldilocks’ market environment, we continue to worry about a world where politics are polarized almost everywhere, interest rates are low globally, and equity valuations are at their peak,” are the words of Brookfield Asset Management. Brookfield was right about politics as stocks experienced their second worst May since the 1960s due to escalation of trade disputes. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards Amerisafe, Inc. (NASDAQ:AMSF) and see how it was affected.

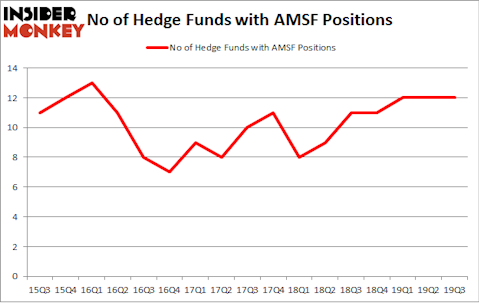

Amerisafe, Inc. (NASDAQ:AMSF) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 12 hedge funds’ portfolios at the end of the third quarter of 2019. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Silicon Motion Technology Corporation (NASDAQ:SIMO), Ebix Inc (NASDAQ:EBIX), and Momenta Pharmaceuticals, Inc. (NASDAQ:MNTA) to gather more data points. Our calculations also showed that AMSF isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 91% since May 2014 and outperformed the Russell 2000 ETFs by nearly 40 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

David Harding of Winton Capital Management

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. Let’s take a peek at the new hedge fund action encompassing Amerisafe, Inc. (NASDAQ:AMSF).

How are hedge funds trading Amerisafe, Inc. (NASDAQ:AMSF)?

At Q3’s end, a total of 12 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the second quarter of 2019. Below, you can check out the change in hedge fund sentiment towards AMSF over the last 17 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

More specifically, Renaissance Technologies was the largest shareholder of Amerisafe, Inc. (NASDAQ:AMSF), with a stake worth $17.4 million reported as of the end of September. Trailing Renaissance Technologies was Citadel Investment Group, which amassed a stake valued at $5.4 million. Two Sigma Advisors, Millennium Management, and Winton Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Weld Capital Management allocated the biggest weight to Amerisafe, Inc. (NASDAQ:AMSF), around 0.04% of its 13F portfolio. Driehaus Capital is also relatively very bullish on the stock, dishing out 0.03 percent of its 13F equity portfolio to AMSF.

Seeing as Amerisafe, Inc. (NASDAQ:AMSF) has experienced falling interest from the entirety of the hedge funds we track, we can see that there is a sect of hedgies that elected to cut their positions entirely heading into Q4. Interestingly, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital dumped the biggest investment of all the hedgies watched by Insider Monkey, valued at close to $0.3 million in stock. Noam Gottesman’s fund, GLG Partners, also sold off its stock, about $0.2 million worth. These moves are intriguing to say the least, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Amerisafe, Inc. (NASDAQ:AMSF) but similarly valued. We will take a look at Silicon Motion Technology Corporation (NASDAQ:SIMO), Ebix Inc (NASDAQ:EBIX), Momenta Pharmaceuticals, Inc. (NASDAQ:MNTA), and Stamps.com Inc. (NASDAQ:STMP). All of these stocks’ market caps are similar to AMSF’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SIMO | 14 | 150011 | 2 |

| EBIX | 16 | 105290 | -2 |

| MNTA | 17 | 230449 | -2 |

| STMP | 17 | 306736 | -2 |

| Average | 16 | 198122 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16 hedge funds with bullish positions and the average amount invested in these stocks was $198 million. That figure was $40 million in AMSF’s case. Momenta Pharmaceuticals, Inc. (NASDAQ:MNTA) is the most popular stock in this table. On the other hand Silicon Motion Technology Corporation (NASDAQ:SIMO) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Amerisafe, Inc. (NASDAQ:AMSF) is even less popular than SIMO. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on AMSF, though not to the same extent, as the stock returned 7.6% during the fourth quarter (through 11/30) and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.