We can judge whether 3M Company (NYSE:MMM) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, our research shows that these picks historically outperformed the market when we factor in known risk factors.

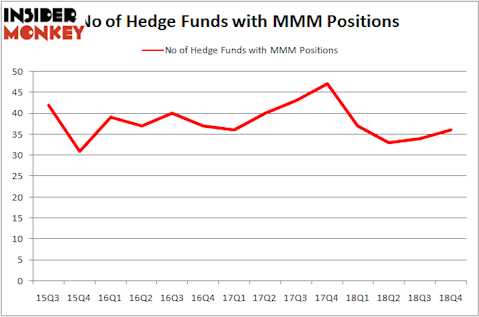

3M Company (NYSE:MMM) was in 36 hedge funds’ portfolios at the end of the fourth quarter of 2018. MMM investors should pay attention to an increase in hedge fund sentiment in recent months. There were 34 hedge funds in our database with MMM positions at the end of the previous quarter. Our calculations also showed that MMM isn’t among the 30 most popular stocks among hedge funds.

At the moment there are several indicators market participants have at their disposal to size up stocks. Some of the most under-the-radar indicators are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the top picks of the top fund managers can trounce the broader indices by a significant amount (see the details here).

Let’s take a look at the fresh hedge fund action surrounding 3M Company (NYSE:MMM).

How are hedge funds trading 3M Company (NYSE:MMM)?

At Q4’s end, a total of 36 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 6% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards MMM over the last 14 quarters. With hedge funds’ capital changing hands, there exists a few notable hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

More specifically, Adage Capital Management was the largest shareholder of 3M Company (NYSE:MMM), with a stake worth $107.8 million reported as of the end of September. Trailing Adage Capital Management was AQR Capital Management, which amassed a stake valued at $74.2 million. Citadel Investment Group, Gotham Asset Management, and Markel Gayner Asset Management were also very fond of the stock, giving the stock large weights in their portfolios.

As one would reasonably expect, key money managers have jumped into 3M Company (NYSE:MMM) headfirst. Alyeska Investment Group, managed by Anand Parekh, created the largest position in 3M Company (NYSE:MMM). Alyeska Investment Group had $24.9 million invested in the company at the end of the quarter. Sander Gerber’s Hudson Bay Capital Management also initiated a $5.7 million position during the quarter. The following funds were also among the new MMM investors: Nick Niell’s Arrowgrass Capital Partners, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, and D. E. Shaw’s D E Shaw.

Let’s now take a look at hedge fund activity in other stocks similar to 3M Company (NYSE:MMM). We will take a look at Adobe Inc. (NASDAQ:ADBE), Novo Nordisk A/S (NYSE:NVO), Sanofi (NASDAQ:SNY), and BHP Group (NYSE:BBL). This group of stocks’ market valuations resemble MMM’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ADBE | 84 | 7816431 | 5 |

| NVO | 18 | 2150293 | 1 |

| SNY | 23 | 847479 | -1 |

| BBL | 15 | 713874 | -1 |

| Average | 35 | 2882019 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 35 hedge funds with bullish positions and the average amount invested in these stocks was $2882 million. That figure was $455 million in MMM’s case. Adobe Inc. (NASDAQ:ADBE) is the most popular stock in this table. On the other hand BHP Group (NYSE:BBL) is the least popular one with only 15 bullish hedge fund positions. 3M Company (NYSE:MMM) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Unfortunately MMM wasn’t in this group. Hedge funds that bet on MMM were disappointed as the stock returned 10.0% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 13 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.