Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Facebook Inc (NASDAQ:FB).

Is Facebook Inc (NASDAQ:FB) a buy here? Money managers are becoming less hopeful. The number of long hedge fund positions were trimmed by 3 recently. However, our calculations also showed that FB is the #1 stock among the 30 most popular stocks among hedge funds (see the video below for previous rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To the average investor there are numerous metrics shareholders use to size up their stock investments. Some of the most under-the-radar metrics are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the best picks of the elite money managers can outperform their index-focused peers by a very impressive amount (see the details here).

Let’s review the recent hedge fund action encompassing Facebook Inc (NASDAQ:FB).

What does smart money think about Facebook Inc (NASDAQ:FB)?

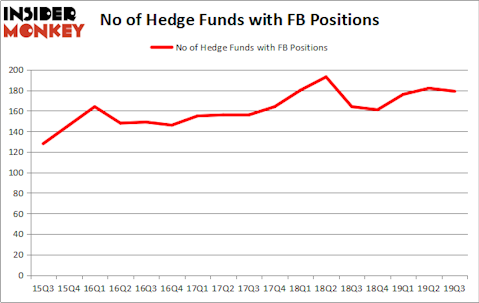

Heading into the fourth quarter of 2019, a total of 179 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -2% from the second quarter of 2019. On the other hand, there were a total of 164 hedge funds with a bullish position in FB a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Chase Coleman’s Tiger Global Management has the most valuable position in Facebook Inc (NASDAQ:FB), worth close to $1.9983 billion, comprising 10.6% of its total 13F portfolio. Coming in second is Viking Global, managed by Andreas Halvorsen, which holds a $1.1105 billion position; 5.8% of its 13F portfolio is allocated to the company. Remaining professional money managers that hold long positions comprise Cliff Asness’s AQR Capital Management, Renaissance Technologies and Boykin Curry’s Eagle Capital Management. In terms of the portfolio weights assigned to each position Harvard Management Co allocated the biggest weight to Facebook Inc (NASDAQ:FB), around 37.6% of its portfolio. Immersion Capital is also relatively very bullish on the stock, designating 30.6 percent of its 13F equity portfolio to FB.

Seeing as Facebook Inc (NASDAQ:FB) has witnessed a decline in interest from the smart money, it’s safe to say that there were a few funds that slashed their positions entirely by the end of the second quarter. Interestingly, Karthik Sarma’s SRS Investment Management cut the biggest position of all the hedgies tracked by Insider Monkey, comprising an estimated $447.4 million in stock. Glenn Greenberg’s fund, Brave Warrior Capital, also said goodbye to its stock, about $111.5 million worth. These moves are interesting, as aggregate hedge fund interest dropped by 3 funds by the end of the second quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Facebook Inc (NASDAQ:FB) but similarly valued. These stocks are Alibaba Group Holding Limited (NYSE:BABA), Visa Inc (NYSE:V), JPMorgan Chase & Co. (NYSE:JPM), and Johnson & Johnson (NYSE:JNJ). All of these stocks’ market caps match FB’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BABA | 149 | 19197070 | 22 |

| V | 132 | 15686359 | 15 |

| JPM | 84 | 11167465 | -6 |

| JNJ | 76 | 7326703 | 13 |

| Average | 110.25 | 13344399 | 11 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 110.25 hedge funds with bullish positions and the average amount invested in these stocks was $13344 million. That figure was $20837 million in FB’s case. Alibaba Group Holding Limited (NYSE:BABA) is the most popular stock in this table. On the other hand Johnson & Johnson (NYSE:JNJ) is the least popular one with only 76 bullish hedge fund positions. Compared to these stocks Facebook Inc (NASDAQ:FB) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. Hedge funds were also right about betting on FB as the stock returned 11.6% during Q4 (through 11/22) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.