After several tireless days we have finished crunching the numbers from 752 13F filings issued by the elite hedge funds and other investment firms that we track at Insider Monkey, which disclosed those firms’ equity portfolios as of September 30th. The results of that effort will be put on display in this article, as we share valuable insight into the smart money sentiment towards Fidelity National Information Services Inc. (NYSE:FIS) and its peers such as Banco Santander (Brasil) SA (NYSE:BSBR), Stryker Corporation (NYSE:SYK), Gilead Sciences, Inc. (NASDAQ:GILD), and Mondelez International Inc (NASDAQ:MDLZ).

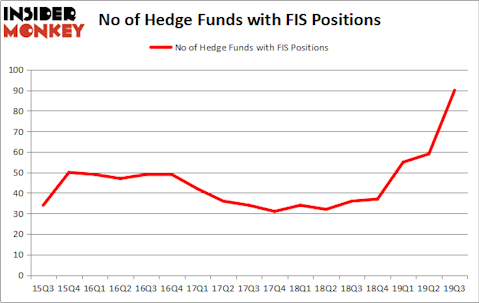

Fidelity National Information Services Inc. (NYSE:FIS) investors should pay attention to a huge increase in support from the world’s most elite money managers recently. FIS was in 90 hedge funds’ portfolios at the end of the third quarter of 2019. There were 59 hedge funds in our database with FIS positions at the end of June. Our calculations also showed that FIS now ranks 19th overall among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To most shareholders, hedge funds are perceived as underperforming, outdated investment tools of yesteryear. While there are more than 8000 funds trading at the moment, We choose to focus on the leaders of this group, around 750 funds. It is estimated that this group of investors watch over the lion’s share of the smart money’s total capital, and by shadowing their top stock picks, Insider Monkey has deciphered many investment strategies that have historically outstripped the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy beat the S&P 500 short ETFs by around 20 percentage points annually since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

William Von Mueffling of Cantillon Capital Management

Let’s take a look at the new hedge fund action encompassing Fidelity National Information Services Inc. (NYSE:FIS).

Hedge fund activity in Fidelity National Information Services Inc. (NYSE:FIS)

At Q3’s end, a total of 90 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 53% from the second quarter of 2019. On the other hand, there were a total of 36 hedge funds with a bullish position in FIS a year ago. With the smart money’s capital changing hands, there exists a few noteworthy hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

The largest stake in Fidelity National Information Services Inc. (NYSE:FIS) was held by Cantillon Capital Management, which reported holding $551.5 million worth of stock at the end of September. It was followed by Citadel Investment Group with a $519.7 million position. Other investors bullish on the company included Melvin Capital Management, Steadfast Capital Management, and Farallon Capital. In terms of the portfolio weights assigned to each position Atalan Capital allocated the biggest weight to Fidelity National Information Services Inc. (NYSE:FIS), around 12.17% of its portfolio. BlueSpruce Investments is also relatively very bullish on the stock, earmarking 11.3 percent of its 13F equity portfolio to FIS.

With a general bullishness amongst the heavyweights, key hedge funds have been driving this bullishness. Third Point, managed by Dan Loeb, initiated the most valuable position in Fidelity National Information Services Inc. (NYSE:FIS). Third Point had $331.9 million invested in the company at the end of the quarter. Tim Hurd and Ed Magnus’s BlueSpruce Investments also made a $293.6 million investment in the stock during the quarter. The other funds with brand new FIS positions are Aaron Cowen’s Suvretta Capital Management, Ric Dillon’s Diamond Hill Capital, and Robert Joseph Caruso’s Select Equity Group.

Let’s go over hedge fund activity in other stocks similar to Fidelity National Information Services Inc. (NYSE:FIS). We will take a look at Banco Santander (Brasil) SA (NYSE:BSBR), Stryker Corporation (NYSE:SYK), Gilead Sciences, Inc. (NASDAQ:GILD), and Mondelez International Inc (NASDAQ:MDLZ). This group of stocks’ market valuations are closest to FIS’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BSBR | 14 | 125130 | 3 |

| SYK | 33 | 527278 | 3 |

| GILD | 58 | 3262691 | 1 |

| MDLZ | 52 | 2813252 | 5 |

| Average | 39.25 | 1682088 | 3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 39.25 hedge funds with bullish positions and the average amount invested in these stocks was $1682 million. That figure was $7126 million in FIS’s case. Gilead Sciences, Inc. (NASDAQ:GILD) is the most popular stock in this table. On the other hand Banco Santander (Brasil) SA (NYSE:BSBR) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Fidelity National Information Services Inc. (NYSE:FIS) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. Unfortunately FIS wasn’t nearly as successful as most of these 20 stocks and hedge funds that were betting on FIS were disappointed as the stock returned 2% during the fourth quarter (through 11/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the rest of the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.