Insider Monkey has processed numerous 13F filings of hedge funds and successful value investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the third quarter. You can find articles about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves over the last 4 years and analyze what the smart money thinks of salesforce.com, inc. (NYSE:CRM) based on that data.

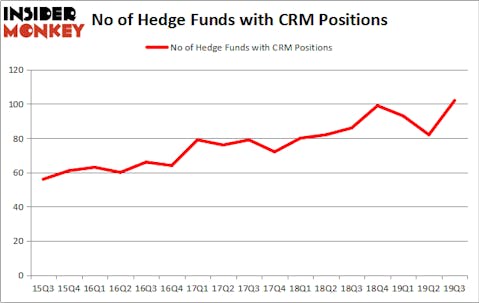

salesforce.com, inc. (NYSE:CRM) investors should be aware of an increase in activity from the world’s largest hedge funds in recent months. CRM was in 102 hedge funds’ portfolios at the end of September. There were 82 hedge funds in our database with CRM holdings at the end of the previous quarter. Our calculations also showed that CRM ranked 11th overall among the 30 most popular stocks among hedge funds (see the video below). Later in the article we will compare CRM’s popularity against BP plc (NYSE:BP), International Business Machines Corp. (NYSE:IBM), Costco Wholesale Corporation (NASDAQ:COST), and BHP Group (NYSE:BHP).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s take a gander at the key hedge fund action surrounding salesforce.com, inc. (NYSE:CRM).

How have hedgies been trading salesforce.com, inc. (NYSE:CRM)?

Heading into the fourth quarter of 2019, a total of 102 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 24% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards CRM over the last 17 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Fisher Asset Management, managed by Ken Fisher, holds the biggest position in salesforce.com, inc. (NYSE:CRM). Fisher Asset Management has a $1.0784 billion position in the stock, comprising 1.2% of its 13F portfolio. The second most bullish fund manager is Lone Pine Capital, managed by Stephen Mandel, which holds a $757.8 million position; the fund has 4.5% of its 13F portfolio invested in the stock. Remaining peers with similar optimism comprise David Goel and Paul Ferri’s Matrix Capital Management, Andreas Halvorsen’s Viking Global and Brad Gerstner’s Altimeter Capital Management. In terms of the portfolio weights assigned to each position HMI Capital allocated the biggest weight to salesforce.com, inc. (NYSE:CRM), around 23.7% of its portfolio. Matrix Capital Management is also relatively very bullish on the stock, designating 18.4 percent of its 13F equity portfolio to CRM.

As one would reasonably expect, some big names have been driving this bullishness. Holocene Advisors, managed by Brandon Haley, initiated the most outsized position in salesforce.com, inc. (NYSE:CRM). Holocene Advisors had $283.8 million invested in the company at the end of the quarter. John Armitage’s Egerton Capital Limited also initiated a $283 million position during the quarter. The other funds with new positions in the stock are Mick Hellman’s HMI Capital, Daniel Sundheim’s D1 Capital Partners, and Ryan Frick and Oliver Evans’s Dorsal Capital Management.

Let’s also examine hedge fund activity in other stocks similar to salesforce.com, inc. (NYSE:CRM). These stocks are BP plc (NYSE:BP), International Business Machines Corp. (NYSE:IBM), Costco Wholesale Corporation (NASDAQ:COST), and BHP Group (NYSE:BHP). This group of stocks’ market caps are similar to CRM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BP | 36 | 1617309 | 7 |

| IBM | 42 | 1569607 | -3 |

| COST | 51 | 3861914 | 11 |

| BHP | 21 | 800372 | 2 |

| Average | 37.5 | 1962301 | 4.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 37.5 hedge funds with bullish positions and the average amount invested in these stocks was $1962 million. That figure was $9433 million in CRM’s case. Costco Wholesale Corporation (NASDAQ:COST) is the most popular stock in this table. On the other hand BHP Group (NYSE:BHP) is the least popular one with only 21 bullish hedge fund positions. Compared to these stocks salesforce.com, inc. (NYSE:CRM) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. Hedge funds were also right about betting on CRM as the stock returned 9.7% during Q4 (through 11/22) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.