Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 750 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ recent losses in Facebook. Let’s take a closer look at what the funds we track think about NewMarket Corporation (NYSE:NEU) in this article.

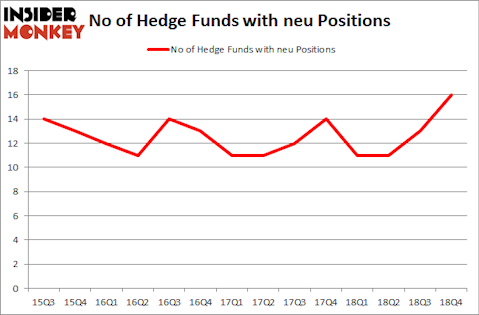

NewMarket Corporation (NYSE:NEU) was in 16 hedge funds’ portfolios at the end of the fourth quarter of 2018. NEU shareholders have witnessed an increase in hedge fund interest in recent months. There were 13 hedge funds in our database with NEU positions at the end of the previous quarter. Our calculations also showed that NEU isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are dozens of methods stock traders employ to evaluate publicly traded companies. A pair of the most useful methods are hedge fund and insider trading signals. Our experts have shown that, historically, those who follow the best picks of the top fund managers can outperform the broader indices by a significant amount (see the details here).

Let’s go over the key hedge fund action encompassing NewMarket Corporation (NYSE:NEU).

What have hedge funds been doing with NewMarket Corporation (NYSE:NEU)?

At Q4’s end, a total of 16 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 23% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in NEU over the last 14 quarters. With hedge funds’ sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

Among these funds, Winton Capital Management held the most valuable stake in NewMarket Corporation (NYSE:NEU), which was worth $28.5 million at the end of the third quarter. On the second spot was Citadel Investment Group which amassed $8.6 million worth of shares. Moreover, GAMCO Investors, Royce & Associates, and D E Shaw were also bullish on NewMarket Corporation (NYSE:NEU), allocating a large percentage of their portfolios to this stock.

Now, some big names have been driving this bullishness. Corsair Capital Management, managed by Jay Petschek and Steven Major, assembled the most valuable position in NewMarket Corporation (NYSE:NEU). Corsair Capital Management had $3.3 million invested in the company at the end of the quarter. Jim Simons’s Renaissance Technologies also made a $1.9 million investment in the stock during the quarter. The other funds with brand new NEU positions are Ray Dalio’s Bridgewater Associates, Benjamin A. Smith’s Laurion Capital Management, and Dmitry Balyasny’s Balyasny Asset Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as NewMarket Corporation (NYSE:NEU) but similarly valued. These stocks are Six Flags Entertainment Corp (NYSE:SIX), Casey’s General Stores, Inc. (NASDAQ:CASY), IDACORP Inc (NYSE:IDA), and Insulet Corporation (NASDAQ:PODD). This group of stocks’ market valuations are similar to NEU’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SIX | 23 | 720468 | -2 |

| CASY | 18 | 55523 | 0 |

| IDA | 20 | 226667 | 9 |

| PODD | 22 | 393036 | 0 |

| Average | 20.75 | 348924 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.75 hedge funds with bullish positions and the average amount invested in these stocks was $349 million. That figure was $65 million in NEU’s case. Six Flags Entertainment Corp (NYSE:SIX) is the most popular stock in this table. On the other hand Casey’s General Stores, Inc. (NASDAQ:CASY) is the least popular one with only 18 bullish hedge fund positions. Compared to these stocks NewMarket Corporation (NYSE:NEU) is even less popular than CASY. Our calculations showed that top 15 most popular stocks among hedge funds returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. Unfortunately NEU wasn’t in this group. Hedge funds that bet on NEU were disappointed as the stock returned 4.9% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 12 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.