Coronavirus is probably the #1 concern in investors’ minds right now. It should be. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW. We predicted that a US recession is imminent and US stocks will go down by at least 20% in the next 3-6 months. We also told you to short the market ETFs and buy long-term bonds. Investors who agreed with us and replicated these trades are up double digits whereas the market is down double digits. Our article also called for a total international travel ban to prevent the spread of the coronavirus especially from Europe. We were one step ahead of the markets and the president (see why hell is coming).

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Is The Hain Celestial Group, Inc. (NASDAQ:HAIN) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

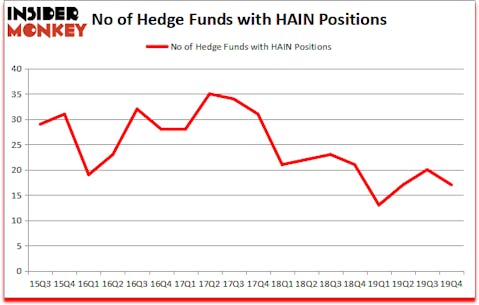

The Hain Celestial Group, Inc. (NASDAQ:HAIN) has seen a decrease in hedge fund interest lately. Our calculations also showed that HAIN isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

Today there are plenty of metrics shareholders can use to value their stock investments. A couple of the most innovative metrics are hedge fund and insider trading sentiment. Our researchers have shown that, historically, those who follow the top picks of the best money managers can beat their index-focused peers by a significant amount (see the details here).

John Petry of Sessa Capital

Keeping this in mind we’re going to take a gander at the new hedge fund action regarding The Hain Celestial Group, Inc. (NASDAQ:HAIN).

What does smart money think about The Hain Celestial Group, Inc. (NASDAQ:HAIN)?

At Q4’s end, a total of 17 of the hedge funds tracked by Insider Monkey were long this stock, a change of -15% from the third quarter of 2019. By comparison, 21 hedge funds held shares or bullish call options in HAIN a year ago. With hedge funds’ sentiment swirling, there exists a select group of noteworthy hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

Among these funds, Engaged Capital held the most valuable stake in The Hain Celestial Group, Inc. (NASDAQ:HAIN), which was worth $546.8 million at the end of the third quarter. On the second spot was Paradice Investment Management which amassed $63.1 million worth of shares. GAMCO Investors, Sessa Capital, and 13D Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Engaged Capital allocated the biggest weight to The Hain Celestial Group, Inc. (NASDAQ:HAIN), around 56.8% of its 13F portfolio. Proxima Capital Management is also relatively very bullish on the stock, earmarking 7.74 percent of its 13F equity portfolio to HAIN.

Because The Hain Celestial Group, Inc. (NASDAQ:HAIN) has witnessed bearish sentiment from the smart money, it’s safe to say that there is a sect of fund managers who were dropping their entire stakes by the end of the third quarter. Interestingly, Steven Boyd’s Armistice Capital cut the largest investment of all the hedgies tracked by Insider Monkey, valued at an estimated $36.5 million in stock. Noam Gottesman’s fund, GLG Partners, also dropped its stock, about $6.4 million worth. These moves are interesting, as total hedge fund interest was cut by 3 funds by the end of the third quarter.

Let’s now take a look at hedge fund activity in other stocks similar to The Hain Celestial Group, Inc. (NASDAQ:HAIN). We will take a look at Cabot Corporation (NYSE:CBT), Rattler Midstream LP (NASDAQ:RTLR), Lexington Realty Trust (NYSE:LXP), and Granite Real Estate Investment Trust (NYSE:GRP). All of these stocks’ market caps match HAIN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CBT | 29 | 139643 | 8 |

| RTLR | 8 | 116513 | -3 |

| LXP | 14 | 61204 | -1 |

| GRP | 7 | 47205 | -4 |

| Average | 14.5 | 91141 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.5 hedge funds with bullish positions and the average amount invested in these stocks was $91 million. That figure was $708 million in HAIN’s case. Cabot Corporation (NYSE:CBT) is the most popular stock in this table. On the other hand Granite Real Estate Investment Trust (NYSE:GRP) is the least popular one with only 7 bullish hedge fund positions. The Hain Celestial Group, Inc. (NASDAQ:HAIN) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 17.4% in 2020 through March 25th but still beat the market by 5.5 percentage points. Hedge funds were also right about betting on HAIN as the stock returned -8.6% during the first quarter (through March 25th) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.