Is Cambium Networks Corporation (NASDAQ:CMBM) a good stock to buy right now? We at Insider Monkey like to examine what billionaires and hedge funds think of a company before spending days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also have numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

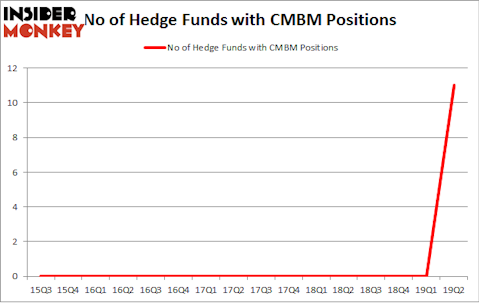

Cambium Networks Corporation (NASDAQ:CMBM) was in 11 hedge funds’ portfolios at the end of the second quarter of 2019. CMBM investors should pay attention to an increase in hedge fund sentiment lately. There were 0 hedge funds in our database with CMBM positions at the end of the previous quarter. Our calculations also showed that CMBM isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

According to most investors, hedge funds are viewed as slow, outdated investment vehicles of yesteryear. While there are greater than 8000 funds trading at present, Our researchers choose to focus on the elite of this group, about 750 funds. These money managers watch over bulk of the smart money’s total asset base, and by watching their top stock picks, Insider Monkey has formulated numerous investment strategies that have historically outstripped the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by around 5 percentage points per year since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

In addition to following the biggest hedge funds for investment ideas, we also share stock pitches from conferences, investor letters and other sources like this one where the fund manager is talking about two under the radar 1000% return potential stocks: first one in internet infrastructure and the second in the heart of advertising market. We use hedge fund buy/sell signals to determine whether to conduct in-depth analysis of these stock ideas which take days. Let’s take a look at the latest hedge fund action surrounding Cambium Networks Corporation (NASDAQ:CMBM).

What have hedge funds been doing with Cambium Networks Corporation (NASDAQ:CMBM)?

At the end of the second quarter, a total of 11 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 11 from the previous quarter. Below, you can check out the change in hedge fund sentiment towards CMBM over the last 16 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Point72 Asset Management held the most valuable stake in Cambium Networks Corporation (NASDAQ:CMBM), which was worth $1.9 million at the end of the second quarter. On the second spot was Laurion Capital Management which amassed $1.9 million worth of shares. Moreover, Element Capital Management, HBK Investments, and Empyrean Capital Partners were also bullish on Cambium Networks Corporation (NASDAQ:CMBM), allocating a large percentage of their portfolios to this stock.

With a general bullishness amongst the heavyweights, specific money managers have jumped into Cambium Networks Corporation (NASDAQ:CMBM) headfirst. Point72 Asset Management, managed by Steve Cohen, created the biggest position in Cambium Networks Corporation (NASDAQ:CMBM). Point72 Asset Management had $1.9 million invested in the company at the end of the quarter. Benjamin A. Smith’s Laurion Capital Management also made a $1.9 million investment in the stock during the quarter. The following funds were also among the new CMBM investors: Jeffrey Talpins’s Element Capital Management, David Costen Haley’s HBK Investments, and Michael A. Price and Amos Meron’s Empyrean Capital Partners.

Let’s check out hedge fund activity in other stocks similar to Cambium Networks Corporation (NASDAQ:CMBM). We will take a look at Athersys, Inc. (NASDAQ:ATHX), Orrstown Financial Services, Inc. (NASDAQ:ORRF), Evelo Biosciences, Inc. (NASDAQ:EVLO), and LCNB Corp. (NASDAQ:LCNB). All of these stocks’ market caps resemble CMBM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ATHX | 5 | 2007 | -1 |

| ORRF | 3 | 10783 | -1 |

| EVLO | 2 | 8054 | 0 |

| LCNB | 1 | 3741 | -1 |

| Average | 2.75 | 6146 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 2.75 hedge funds with bullish positions and the average amount invested in these stocks was $6 million. That figure was $12 million in CMBM’s case. Athersys, Inc. (NASDAQ:ATHX) is the most popular stock in this table. On the other hand LCNB Corp. (NASDAQ:LCNB) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks Cambium Networks Corporation (NASDAQ:CMBM) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately CMBM wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on CMBM were disappointed as the stock returned 1.1% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market in Q3.

Disclosure: None. This article was originally published at Insider Monkey.