Is GrafTech International Ltd. (NYSE:EAF) a good stock to buy right now? We at Insider Monkey like to examine what billionaires and hedge funds think of a company before spending days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also employ numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

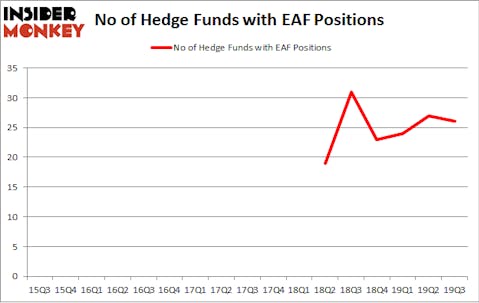

GrafTech International Ltd. (NYSE:EAF) was in 26 hedge funds’ portfolios at the end of September. EAF has seen a decrease in hedge fund sentiment lately. There were 27 hedge funds in our database with EAF holdings at the end of the previous quarter. Our calculations also showed that EAF isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.8% through November 21, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Donald Yacktman of Yacktman Asset Management

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to analyze the new hedge fund action regarding GrafTech International Ltd. (NYSE:EAF).

Hedge fund activity in GrafTech International Ltd. (NYSE:EAF)

At Q3’s end, a total of 26 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -4% from the second quarter of 2019. Below, you can check out the change in hedge fund sentiment towards EAF over the last 17 quarters. With hedgies’ sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Pabrai Funds, managed by Mohnish Pabrai, holds the largest position in GrafTech International Ltd. (NYSE:EAF). Pabrai Funds has a $71 million position in the stock, comprising 27.2% of its 13F portfolio. Sitting at the No. 2 spot is AQR Capital Management, managed by Cliff Asness, which holds a $36.6 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Some other hedge funds and institutional investors with similar optimism include Donald Yacktman’s Yacktman Asset Management, Edward Goodnow’s Goodnow Investment Group and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital. In terms of the portfolio weights assigned to each position Pabrai Funds allocated the biggest weight to GrafTech International Ltd. (NYSE:EAF), around 27.17% of its portfolio. Anchor Bolt Capital is also relatively very bullish on the stock, earmarking 4.36 percent of its 13F equity portfolio to EAF.

Seeing as GrafTech International Ltd. (NYSE:EAF) has experienced falling interest from the smart money, it’s safe to say that there was a specific group of fund managers who sold off their positions entirely heading into Q4. Intriguingly, John R. Wagner’s SCW Capital Management cut the largest position of the “upper crust” of funds watched by Insider Monkey, totaling about $12.7 million in stock, and Nathaniel August’s Mangrove Partners was right behind this move, as the fund sold off about $11.1 million worth. These transactions are important to note, as total hedge fund interest fell by 1 funds heading into Q4.

Let’s also examine hedge fund activity in other stocks similar to GrafTech International Ltd. (NYSE:EAF). These stocks are Alcoa Corporation (NYSE:AA), Ardagh Group S.A. (NYSE:ARD), Apple Hospitality REIT Inc (NYSE:APLE), and Equitrans Midstream Corporation (NYSE:ETRN). This group of stocks’ market valuations are similar to EAF’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AA | 28 | 530144 | 2 |

| ARD | 12 | 63888 | 1 |

| APLE | 12 | 106485 | -2 |

| ETRN | 16 | 334604 | 0 |

| Average | 17 | 258780 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17 hedge funds with bullish positions and the average amount invested in these stocks was $259 million. That figure was $276 million in EAF’s case. Alcoa Corporation (NYSE:AA) is the most popular stock in this table. On the other hand Ardagh Group S.A. (NYSE:ARD) is the least popular one with only 12 bullish hedge fund positions. GrafTech International Ltd. (NYSE:EAF) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on EAF as the stock returned 10.7% during the fourth quarter (through the end of November) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.