How do you pick the next stock to invest in? One way would be to spend days of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don’t always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding McCormick & Company, Incorporated (NYSE:MKC).

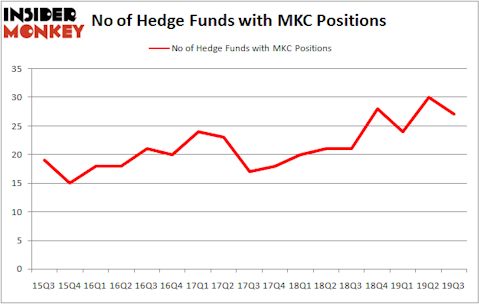

Is McCormick & Company, Incorporated (NYSE:MKC) ready to rally soon? Prominent investors are in a pessimistic mood. The number of bullish hedge fund positions went down by 3 lately. Our calculations also showed that MKC isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings). MKC was in 27 hedge funds’ portfolios at the end of September. There were 30 hedge funds in our database with MKC holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

If you’d ask most investors, hedge funds are assumed to be slow, old investment tools of years past. While there are over 8000 funds in operation at the moment, Our researchers choose to focus on the crème de la crème of this club, around 750 funds. Most estimates calculate that this group of people orchestrate most of the hedge fund industry’s total capital, and by following their highest performing picks, Insider Monkey has determined several investment strategies that have historically outperformed the broader indices. Insider Monkey’s flagship short hedge fund strategy outpaced the S&P 500 short ETFs by around 20 percentage points per annum since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to take a peek at the new hedge fund action surrounding McCormick & Company, Incorporated (NYSE:MKC).

How are hedge funds trading McCormick & Company, Incorporated (NYSE:MKC)?

Heading into the fourth quarter of 2019, a total of 27 of the hedge funds tracked by Insider Monkey were long this stock, a change of -10% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in MKC over the last 17 quarters. With the smart money’s capital changing hands, there exists a few noteworthy hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, AQR Capital Management, managed by Cliff Asness, holds the biggest position in McCormick & Company, Incorporated (NYSE:MKC). AQR Capital Management has a $59.8 million position in the stock, comprising 0.1% of its 13F portfolio. The second most bullish fund manager is Adage Capital Management, led by Phill Gross and Robert Atchinson, holding a $23.2 million position; 0.1% of its 13F portfolio is allocated to the company. Some other hedge funds and institutional investors that hold long positions consist of David E. Shaw’s D E Shaw, Anna Nikolayevsky’s Axel Capital Management and Noam Gottesman’s GLG Partners. In terms of the portfolio weights assigned to each position Axel Capital Management allocated the biggest weight to McCormick & Company, Incorporated (NYSE:MKC), around 6.09% of its portfolio. Cognios Capital is also relatively very bullish on the stock, setting aside 0.91 percent of its 13F equity portfolio to MKC.

Seeing as McCormick & Company, Incorporated (NYSE:MKC) has witnessed bearish sentiment from the smart money, we can see that there were a few hedge funds that decided to sell off their full holdings heading into Q4. Interestingly, George Soros’s Soros Fund Management sold off the largest investment of the 750 funds tracked by Insider Monkey, valued at close to $27.1 million in stock, and Brad Dunkley and Blair Levinsky’s Waratah Capital Advisors was right behind this move, as the fund cut about $3.4 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest was cut by 3 funds heading into Q4.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as McCormick & Company, Incorporated (NYSE:MKC) but similarly valued. We will take a look at The Kroger Co. (NYSE:KR), Weyerhaeuser Co. (NYSE:WY), Synopsys, Inc. (NASDAQ:SNPS), and Spotify Technology S.A. (NYSE:SPOT). This group of stocks’ market valuations resemble MKC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KR | 25 | 632469 | -3 |

| WY | 28 | 451903 | 0 |

| SNPS | 40 | 1362195 | -2 |

| SPOT | 37 | 1470342 | -5 |

| Average | 32.5 | 979227 | -2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 32.5 hedge funds with bullish positions and the average amount invested in these stocks was $979 million. That figure was $138 million in MKC’s case. Synopsys, Inc. (NASDAQ:SNPS) is the most popular stock in this table. On the other hand The Kroger Co. (NYSE:KR) is the least popular one with only 25 bullish hedge fund positions. McCormick & Company, Incorporated (NYSE:MKC) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on MKC, though not to the same extent, as the stock returned 8.7% during the first two months of the fourth quarter and outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.