Coronavirus is probably the #1 concern in investors’ minds right now. It should be. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW. We predicted that a US recession is imminent and US stocks will go down by at least 20% in the next 3-6 months. We also told you to short the market ETFs and buy long-term bonds. Investors who agreed with us and replicated these trades are up double digits whereas the market is down double digits. Our article also called for a total international travel ban to prevent the spread of the coronavirus especially from Europe. We were one step ahead of the markets and the president. In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in The Southern Company (NYSE:SO)? The smart money sentiment can provide an answer to this question.

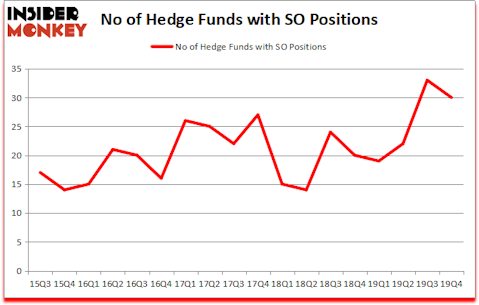

Is The Southern Company (NYSE:SO) a buy here? The smart money is reducing their bets on the stock. The number of bullish hedge fund bets dropped by 3 lately. Our calculations also showed that SO isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video below for Q3 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by more than 41 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 35.3% through March 3rd. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

David Harding of Winton Capital Management

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. In January, we recommended a long position in one of the most shorted stocks in the market, and that stock returned more than 50% despite the large losses in the market since our recommendation. With all of this in mind let’s take a gander at the latest hedge fund action surrounding The Southern Company (NYSE:SO).

What does smart money think about The Southern Company (NYSE:SO)?

At the end of the fourth quarter, a total of 30 of the hedge funds tracked by Insider Monkey were long this stock, a change of -9% from the previous quarter. On the other hand, there were a total of 20 hedge funds with a bullish position in SO a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in The Southern Company (NYSE:SO) was held by Renaissance Technologies, which reported holding $384 million worth of stock at the end of September. It was followed by Zimmer Partners with a $223.3 million position. Other investors bullish on the company included AQR Capital Management, Two Sigma Advisors, and GLG Partners. In terms of the portfolio weights assigned to each position Zimmer Partners allocated the biggest weight to The Southern Company (NYSE:SO), around 3.09% of its 13F portfolio. Horseman Capital Management is also relatively very bullish on the stock, designating 1.09 percent of its 13F equity portfolio to SO.

Due to the fact that The Southern Company (NYSE:SO) has faced declining sentiment from the smart money, we can see that there were a few hedgies that decided to sell off their positions entirely last quarter. Intriguingly, Steve Cohen’s Point72 Asset Management sold off the largest stake of the “upper crust” of funds monitored by Insider Monkey, valued at an estimated $53.9 million in stock, and Clint Carlson’s Carlson Capital was right behind this move, as the fund dumped about $37.1 million worth. These transactions are interesting, as aggregate hedge fund interest fell by 3 funds last quarter.

Let’s also examine hedge fund activity in other stocks similar to The Southern Company (NYSE:SO). We will take a look at S&P Global Inc. (NYSE:SPGI), Duke Energy Corporation (NYSE:DUK), Equinor ASA (NYSE:EQNR), and Target Corporation (NYSE:TGT). This group of stocks’ market caps match SO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SPGI | 76 | 3764961 | 1 |

| DUK | 37 | 1534613 | 5 |

| EQNR | 14 | 424786 | -1 |

| TGT | 53 | 2495450 | -2 |

| Average | 45 | 2054953 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 45 hedge funds with bullish positions and the average amount invested in these stocks was $2055 million. That figure was $866 million in SO’s case. S&P Global Inc. (NYSE:SPGI) is the most popular stock in this table. On the other hand Equinor ASA (NYSE:EQNR) is the least popular one with only 14 bullish hedge fund positions. The Southern Company (NYSE:SO) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 11.7% in 2020 through March 11th but still beat the market by 3.1 percentage points. A small number of hedge funds were also right about betting on SO as the stock returned -7.8% during the same time period and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.