Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 750 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ 2018 losses in Facebook and Apple. Let’s take a closer look at what the funds we track think about MongoDB, Inc. (NASDAQ:MDB) in this article.

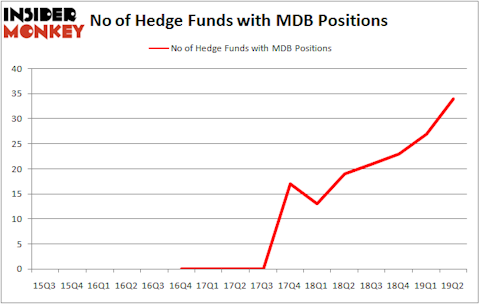

MongoDB, Inc. (NASDAQ:MDB) was in 34 hedge funds’ portfolios at the end of the second quarter of 2019. MDB investors should be aware of an increase in hedge fund interest of late. There were 27 hedge funds in our database with MDB positions at the end of the previous quarter. Our calculations also showed that MDB isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a multitude of metrics investors employ to analyze publicly traded companies. A pair of the most useful metrics are hedge fund and insider trading signals. Our experts have shown that, historically, those who follow the top picks of the top investment managers can outclass their index-focused peers by a healthy amount (see the details here).

Unlike this former hedge fund manager who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a look at the recent hedge fund action regarding MongoDB, Inc. (NASDAQ:MDB).

How are hedge funds trading MongoDB, Inc. (NASDAQ:MDB)?

At the end of the second quarter, a total of 34 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 26% from one quarter earlier. By comparison, 19 hedge funds held shares or bullish call options in MDB a year ago. With hedgies’ sentiment swirling, there exists an “upper tier” of key hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

More specifically, Whale Rock Capital Management was the largest shareholder of MongoDB, Inc. (NASDAQ:MDB), with a stake worth $181.8 million reported as of the end of March. Trailing Whale Rock Capital Management was D E Shaw, which amassed a stake valued at $124.8 million. SCGE Management, SQN Investors, and Citadel Investment Group were also very fond of the stock, giving the stock large weights in their portfolios.

Now, key money managers have been driving this bullishness. Holocene Advisors, managed by Brandon Haley, established the largest position in MongoDB, Inc. (NASDAQ:MDB). Holocene Advisors had $34.1 million invested in the company at the end of the quarter. Zach Schreiber’s Point State Capital also made a $31.9 million investment in the stock during the quarter. The other funds with new positions in the stock are Steve Cohen’s Point72 Asset Management, Cliff Asness’s AQR Capital Management, and Ira Unschuld’s Brant Point Investment Management.

Let’s also examine hedge fund activity in other stocks similar to MongoDB, Inc. (NASDAQ:MDB). We will take a look at Ralph Lauren Corporation (NYSE:RL), BorgWarner Inc. (NYSE:BWA), Companhia de Saneamento Basico do Estado de Sao Paulo – SABESP (NYSE:SBS), and StoneCo Ltd. (NASDAQ:STNE). All of these stocks’ market caps are closest to MDB’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RL | 35 | 1097213 | 1 |

| BWA | 21 | 831068 | 0 |

| SBS | 12 | 451545 | -4 |

| STNE | 27 | 1129870 | 4 |

| Average | 23.75 | 877424 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.75 hedge funds with bullish positions and the average amount invested in these stocks was $877 million. That figure was $792 million in MDB’s case. Ralph Lauren Corporation (NYSE:RL) is the most popular stock in this table. On the other hand Companhia de Saneamento Basico do Estado de Sao Paulo – SABESP (NYSE:SBS) is the least popular one with only 12 bullish hedge fund positions. MongoDB, Inc. (NASDAQ:MDB) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately MDB wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on MDB were disappointed as the stock returned -20.8% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.