The financial regulations require hedge funds and wealthy investors that exceeded the $100 million equity holdings threshold to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings to a certain extent level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on September 30th. We at Insider Monkey have made an extensive database of nearly 750 of those established hedge funds and famous value investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Catalent Inc (NYSE:CTLT) based on those filings.

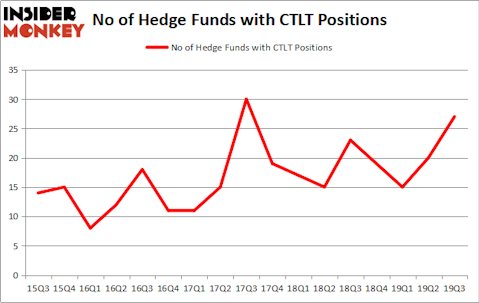

Catalent Inc (NYSE:CTLT) has experienced an increase in activity from the world’s largest hedge funds in recent months. CTLT was in 27 hedge funds’ portfolios at the end of September. There were 20 hedge funds in our database with CTLT holdings at the end of the previous quarter. Our calculations also showed that CTLT isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To most investors, hedge funds are assumed to be unimportant, old financial tools of years past. While there are more than 8000 funds trading today, Our researchers hone in on the top tier of this group, around 750 funds. These hedge fund managers orchestrate bulk of all hedge funds’ total capital, and by keeping track of their unrivaled equity investments, Insider Monkey has figured out several investment strategies that have historically beaten Mr. Market. Insider Monkey’s flagship short hedge fund strategy outpaced the S&P 500 short ETFs by around 20 percentage points per annum since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Andreas Halvorsen of Viking Global

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s analyze the fresh hedge fund action regarding Catalent Inc (NYSE:CTLT).

What have hedge funds been doing with Catalent Inc (NYSE:CTLT)?

Heading into the fourth quarter of 2019, a total of 27 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 35% from the second quarter of 2019. By comparison, 23 hedge funds held shares or bullish call options in CTLT a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Viking Global held the most valuable stake in Catalent Inc (NYSE:CTLT), which was worth $67.9 million at the end of the third quarter. On the second spot was Citadel Investment Group which amassed $63.1 million worth of shares. Partner Fund Management, Highline Capital Management, and D E Shaw were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Highline Capital Management allocated the biggest weight to Catalent Inc (NYSE:CTLT), around 7.34% of its portfolio. Partner Fund Management is also relatively very bullish on the stock, setting aside 1.56 percent of its 13F equity portfolio to CTLT.

Consequently, specific money managers were leading the bulls’ herd. Renaissance Technologies assembled the biggest position in Catalent Inc (NYSE:CTLT). Renaissance Technologies had $24.4 million invested in the company at the end of the quarter. Brad Farber’s Atika Capital also made a $5.3 million investment in the stock during the quarter. The following funds were also among the new CTLT investors: Ken Fisher’s Fisher Asset Management, Sander Gerber’s Hudson Bay Capital Management, and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Catalent Inc (NYSE:CTLT) but similarly valued. These stocks are TIM Participacoes SA (NYSE:TSU), Ceridian HCM Holding Inc. (NYSE:CDAY), Autoliv Inc. (NYSE:ALV), and Molina Healthcare, Inc. (NYSE:MOH). This group of stocks’ market valuations are closest to CTLT’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TSU | 13 | 290605 | 1 |

| CDAY | 28 | 1115679 | 6 |

| ALV | 14 | 627166 | 1 |

| MOH | 25 | 1040324 | -7 |

| Average | 20 | 768444 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20 hedge funds with bullish positions and the average amount invested in these stocks was $768 million. That figure was $393 million in CTLT’s case. Ceridian HCM Holding Inc. (NYSE:CDAY) is the most popular stock in this table. On the other hand TIM Participacoes SA (NYSE:TSU) is the least popular one with only 13 bullish hedge fund positions. Catalent Inc (NYSE:CTLT) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on CTLT, though not to the same extent, as the stock returned 9.1% during the first two months of the fourth quarter and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.