Coronavirus is probably the #1 concern in investors’ minds right now. It should be. On February 27th we publish an article with the title “Recession is Imminent: We Need A Travel Ban NOW”. We predicted that a US recession is imminent and US stocks will go down by at least 20% in the next 3-6 months. We also told you to short the market ETFs and buy long-term bonds. Investors who agreed with us and replicated these trades are up double digits whereas the market is down double digits. Our article also called for a total international travel ban to prevent the spread of the coronavirus especially from Europe. We were one step ahead of the markets and the president.

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We at Insider Monkey have plowed through 835 13F filings that hedge funds and well-known value investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of December 31st. In this article we look at what those investors think of Tempur Sealy International Inc. (NYSE:TPX).

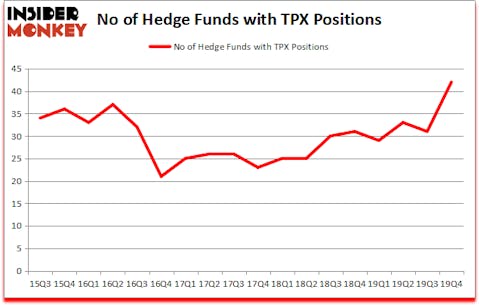

Is Tempur Sealy International Inc. (NYSE:TPX) a superb investment today? The best stock pickers are taking an optimistic view. The number of bullish hedge fund positions went up by 11 recently. Our calculations also showed that TPX isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video below for Q3 rankings). TPX was in 42 hedge funds’ portfolios at the end of December. There were 31 hedge funds in our database with TPX positions at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a lot of signals shareholders have at their disposal to evaluate stocks. Two of the best signals are hedge fund and insider trading interest. We have shown that, historically, those who follow the top picks of the elite money managers can outpace the S&P 500 by a significant amount (see the details here).

David Harding of Winton Capital Management

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. In January, we recommended a long position in one of the most shorted stocks in the market, and that stock returned more than 50% despite the large losses in the market since our recommendation. With all of this in mind let’s take a look at the latest hedge fund action surrounding Tempur Sealy International Inc. (NYSE:TPX).

What have hedge funds been doing with Tempur Sealy International Inc. (NYSE:TPX)?

At Q4’s end, a total of 42 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 35% from one quarter earlier. By comparison, 31 hedge funds held shares or bullish call options in TPX a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, H Partners Management, managed by Rehan Jaffer, holds the largest position in Tempur Sealy International Inc. (NYSE:TPX). H Partners Management has a $496.2 million position in the stock, comprising 69.9% of its 13F portfolio. The second largest stake is held by William Duhamel of Route One Investment Company, with a $275.8 million position; 7.8% of its 13F portfolio is allocated to the stock. Some other professional money managers that are bullish encompass Alexander Mitchell’s Scopus Asset Management, John Overdeck and David Siegel’s Two Sigma Advisors and Steve Cohen’s Point72 Asset Management. In terms of the portfolio weights assigned to each position H Partners Management allocated the biggest weight to Tempur Sealy International Inc. (NYSE:TPX), around 69.92% of its 13F portfolio. AWH Capital is also relatively very bullish on the stock, designating 10.23 percent of its 13F equity portfolio to TPX.

With a general bullishness amongst the heavyweights, key money managers have been driving this bullishness. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, initiated the most outsized position in Tempur Sealy International Inc. (NYSE:TPX). Marshall Wace LLP had $12.2 million invested in the company at the end of the quarter. Brad Stephens’s Six Columns Capital also initiated a $8.3 million position during the quarter. The other funds with brand new TPX positions are David Harding’s Winton Capital Management, Peter Muller’s PDT Partners, and Brad Farber’s Atika Capital.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Tempur Sealy International Inc. (NYSE:TPX) but similarly valued. These stocks are Envista Holdings Corporation (NYSE:NVST), Tetra Tech, Inc. (NASDAQ:TTEK), Mattel, Inc. (NASDAQ:MAT), and Wyndham Destinations, Inc. (NYSE:WYND). This group of stocks’ market valuations are similar to TPX’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NVST | 42 | 1281321 | 21 |

| TTEK | 23 | 103073 | 2 |

| MAT | 19 | 738702 | -5 |

| WYND | 28 | 394113 | 5 |

| Average | 28 | 629302 | 5.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28 hedge funds with bullish positions and the average amount invested in these stocks was $629 million. That figure was $1239 million in TPX’s case. Envista Holdings Corporation (NYSE:NVST) is the most popular stock in this table. On the other hand Mattel, Inc. (NASDAQ:MAT) is the least popular one with only 19 bullish hedge fund positions. Tempur Sealy International Inc. (NYSE:TPX) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 12.9% in 2020 through March 9th but beat the market by 1.9 percentage points. Unfortunately TPX wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on TPX were disappointed as the stock returned -27.1% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.