Reputable billionaire investors such as Jim Simons, Cliff Asness and David Tepper generate exorbitant profits for their wealthy accredited investors (a minimum of $1 million in investable assets would be required to invest in a hedge fund and most successful hedge funds won’t accept your savings unless you commit at least $5 million) by pinpointing winning small-cap stocks. There is little or no publicly-available information at all on some of these small companies, which makes it hard for an individual investor to pin down a winner within the small-cap space. However, hedge funds and other big asset managers can do the due diligence and analysis for you instead, thanks to their highly-skilled research teams and vast resources to conduct an appropriate evaluation process. Looking for potential winners within the small-cap galaxy of stocks? We believe following the smart money is a good starting point.

Is Zayo Group Holdings Inc (NYSE:ZAYO) undervalued? The smart money is buying. The number of long hedge fund bets advanced by 5 in recent months. Our calculations also showed that ZAYO isn’t among the 30 most popular stocks among hedge funds.

Today there are a multitude of signals stock market investors put to use to appraise publicly traded companies. A duo of the most underrated signals are hedge fund and insider trading indicators. We have shown that, historically, those who follow the best picks of the elite investment managers can outclass their index-focused peers by a solid amount (see the details here).

Let’s take a look at the key hedge fund action encompassing Zayo Group Holdings Inc (NYSE:ZAYO).

What have hedge funds been doing with Zayo Group Holdings Inc (NYSE:ZAYO)?

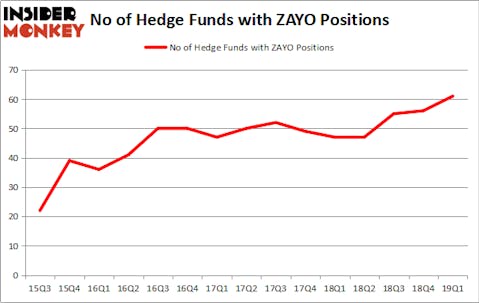

At the end of the first quarter, a total of 61 of the hedge funds tracked by Insider Monkey were long this stock, a change of 9% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in ZAYO over the last 15 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

Among these funds, Citadel Investment Group held the most valuable stake in Zayo Group Holdings Inc (NYSE:ZAYO), which was worth $222.1 million at the end of the first quarter. On the second spot was Sachem Head Capital which amassed $164.8 million worth of shares. Moreover, Senator Investment Group, Eminence Capital, and Starboard Value LP were also bullish on Zayo Group Holdings Inc (NYSE:ZAYO), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, key hedge funds were leading the bulls’ herd. Eminence Capital, managed by Ricky Sandler, initiated the largest position in Zayo Group Holdings Inc (NYSE:ZAYO). Eminence Capital had $156.2 million invested in the company at the end of the quarter. Jeffrey Smith’s Starboard Value LP also initiated a $116.5 million position during the quarter. The other funds with new positions in the stock are Dennis Puri and Oliver Keller’s Hunt Lane Capital, Benjamin Pass’s TOMS Capital, and Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners.

Let’s also examine hedge fund activity in other stocks similar to Zayo Group Holdings Inc (NYSE:ZAYO). These stocks are Genpact Limited (NYSE:G), AerCap Holdings N.V. (NYSE:AER), Gerdau SA (NYSE:GGB), and Guardant Health, Inc. (NASDAQ:GH). This group of stocks’ market values are closest to ZAYO’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| G | 29 | 600991 | 7 |

| AER | 23 | 792415 | -8 |

| GGB | 10 | 168753 | -2 |

| GH | 14 | 174703 | 7 |

| Average | 19 | 434216 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19 hedge funds with bullish positions and the average amount invested in these stocks was $434 million. That figure was $1681 million in ZAYO’s case. Genpact Limited (NYSE:G) is the most popular stock in this table. On the other hand Gerdau SA (NYSE:GGB) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks Zayo Group Holdings Inc (NYSE:ZAYO) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on ZAYO as the stock returned 14.4% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.