Is WesBanco, Inc. (NASDAQ:WSBC) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

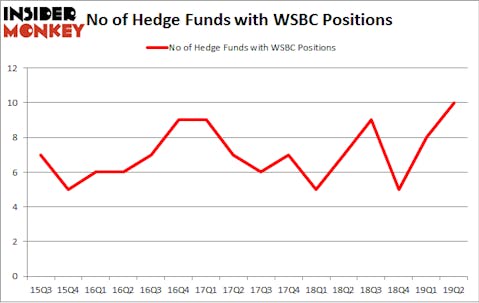

WesBanco, Inc. (NASDAQ:WSBC) investors should pay attention to an increase in enthusiasm from smart money lately. Our calculations also showed that WSBC isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are several metrics stock market investors can use to grade publicly traded companies. A couple of the most useful metrics are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the top picks of the best money managers can outperform the market by a solid margin (see the details here).

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to go over the fresh hedge fund action encompassing WesBanco, Inc. (NASDAQ:WSBC).

What have hedge funds been doing with WesBanco, Inc. (NASDAQ:WSBC)?

Heading into the third quarter of 2019, a total of 10 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 25% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards WSBC over the last 16 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Renaissance Technologies held the most valuable stake in WesBanco, Inc. (NASDAQ:WSBC), which was worth $35.3 million at the end of the second quarter. On the second spot was Millennium Management which amassed $14.9 million worth of shares. Moreover, Marshall Wace LLP, Basswood Capital, and Citadel Investment Group were also bullish on WesBanco, Inc. (NASDAQ:WSBC), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, specific money managers were breaking ground themselves. D E Shaw, managed by D. E. Shaw, created the biggest position in WesBanco, Inc. (NASDAQ:WSBC). D E Shaw had $2.1 million invested in the company at the end of the quarter. Thomas Bailard’s Bailard Inc also made a $0.4 million investment in the stock during the quarter. The only other fund with a brand new WSBC position is Paul Tudor Jones’s Tudor Investment Corp.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as WesBanco, Inc. (NASDAQ:WSBC) but similarly valued. These stocks are Invesco Mortgage Capital Inc (NYSE:IVR), InterDigital, Inc. (NASDAQ:IDCC), Centennial Resource Development, Inc. (NASDAQ:CDEV), and GreenSky, Inc. (NASDAQ:GSKY). All of these stocks’ market caps resemble WSBC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IVR | 11 | 69179 | -4 |

| IDCC | 16 | 224039 | 0 |

| CDEV | 17 | 142786 | 2 |

| GSKY | 20 | 89452 | 5 |

| Average | 16 | 131364 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16 hedge funds with bullish positions and the average amount invested in these stocks was $131 million. That figure was $73 million in WSBC’s case. GreenSky, Inc. (NASDAQ:GSKY) is the most popular stock in this table. On the other hand Invesco Mortgage Capital Inc (NYSE:IVR) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks WesBanco, Inc. (NASDAQ:WSBC) is even less popular than IVR. Hedge funds dodged a bullet by taking a bearish stance towards WSBC. Our calculations showed that the top 20 most popular hedge fund stocks returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately WSBC wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); WSBC investors were disappointed as the stock returned -2.2% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.