Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 750 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ recent losses in Facebook. Let’s take a closer look at what the funds we track think about Weis Markets, Inc. (NYSE:WMK) in this article.

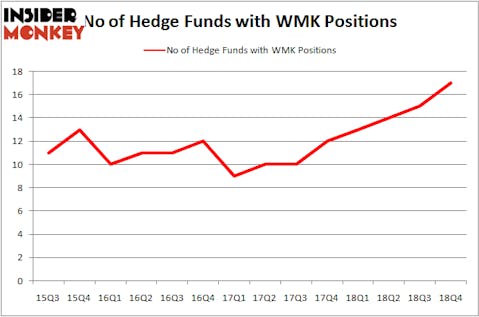

Is Weis Markets, Inc. (NYSE:WMK) a healthy stock for your portfolio? Investors who are in the know are betting on the stock. The number of bullish hedge fund bets went up by 2 lately. Our calculations also showed that WMK isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s analyze the key hedge fund action encompassing Weis Markets, Inc. (NYSE:WMK).

How have hedgies been trading Weis Markets, Inc. (NYSE:WMK)?

At Q4’s end, a total of 17 of the hedge funds tracked by Insider Monkey were long this stock, a change of 13% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in WMK over the last 14 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Weis Markets, Inc. (NYSE:WMK) was held by Royce & Associates, which reported holding $65.7 million worth of stock at the end of December. It was followed by Arrowstreet Capital with a $13.5 million position. Other investors bullish on the company included Renaissance Technologies, AQR Capital Management, and GAMCO Investors.

Consequently, specific money managers have jumped into Weis Markets, Inc. (NYSE:WMK) headfirst. AlphaOne Capital Partners, managed by Paul Hondros, established the most valuable position in Weis Markets, Inc. (NYSE:WMK). AlphaOne Capital Partners had $0.6 million invested in the company at the end of the quarter. Brandon Haley’s Holocene Advisors also initiated a $0.5 million position during the quarter. The other funds with brand new WMK positions are Israel Englander’s Millennium Management, Matthew Hulsizer’s PEAK6 Capital Management, and Philippe Laffont’s Coatue Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Weis Markets, Inc. (NYSE:WMK) but similarly valued. These stocks are Actuant Corporation (NYSE:ATU), Calavo Growers, Inc. (NASDAQ:CVGW), Endava plc (NYSE:DAVA), and Industrial Logistics Properties Trust (NASDAQ:ILPT). This group of stocks’ market valuations are closest to WMK’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ATU | 14 | 245487 | -2 |

| CVGW | 14 | 51082 | 2 |

| DAVA | 6 | 14931 | -2 |

| ILPT | 19 | 203885 | 10 |

| Average | 13.25 | 128846 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.25 hedge funds with bullish positions and the average amount invested in these stocks was $129 million. That figure was $102 million in WMK’s case. Industrial Logistics Properties Trust (NASDAQ:ILPT) is the most popular stock in this table. On the other hand Endava plc (NYSE:DAVA) is the least popular one with only 6 bullish hedge fund positions. Weis Markets, Inc. (NYSE:WMK) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately WMK wasn’t nearly as popular as these 15 stock and hedge funds that were betting on WMK were disappointed as the stock returned -12.3% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.