Most investors tend to think that hedge funds and other asset managers are worthless, as they cannot beat even simple index fund portfolios. In fact, most people expect hedge funds to compete with and outperform the bull market that we have witnessed in recent years. However, hedge funds are generally partially hedged and aim at delivering attractive risk-adjusted returns rather than following the ups and downs of equity markets hoping that they will outperform the broader market. Our research shows that certain hedge funds do have great stock picking skills (and we can identify these hedge funds in advance pretty accurately), so let’s take a glance at the smart money sentiment towards Verra Mobility Corporation (NASDAQ:VRRM).

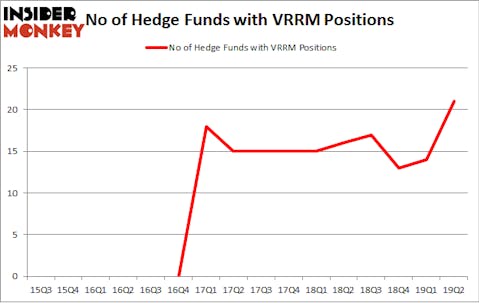

Verra Mobility Corporation (NASDAQ:VRRM) has seen an increase in support from the world’s most elite money managers lately. Our calculations also showed that VRRM isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a gander at the latest hedge fund action regarding Verra Mobility Corporation (NASDAQ:VRRM).

What does smart money think about Verra Mobility Corporation (NASDAQ:VRRM)?

At Q2’s end, a total of 21 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 50% from one quarter earlier. By comparison, 16 hedge funds held shares or bullish call options in VRRM a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Cardinal Capital, managed by Amy Minella, holds the biggest position in Verra Mobility Corporation (NASDAQ:VRRM). Cardinal Capital has a $47.4 million position in the stock, comprising 1.5% of its 13F portfolio. The second largest stake is held by Crescent Park Management, managed by Eli Cohen, which holds a $36.3 million position; the fund has 6.6% of its 13F portfolio invested in the stock. Other professional money managers with similar optimism comprise Jeffrey Jacobowitz’s Simcoe Capital Management, Paul Marshall and Ian Wace’s Marshall Wace LLP and Dmitry Balyasny’s Balyasny Asset Management.

Consequently, specific money managers were breaking ground themselves. Balyasny Asset Management, managed by Dmitry Balyasny, created the biggest position in Verra Mobility Corporation (NASDAQ:VRRM). Balyasny Asset Management had $13.5 million invested in the company at the end of the quarter. Will Cook’s Sunriver Management also initiated a $12.6 million position during the quarter. The other funds with new positions in the stock are Michael A. Price and Amos Meron’s Empyrean Capital Partners, Richard Driehaus’s Driehaus Capital, and David Rodriguez-Fraile’s BlueMar Capital Management.

Let’s now take a look at hedge fund activity in other stocks similar to Verra Mobility Corporation (NASDAQ:VRRM). These stocks are Stepan Company (NYSE:SCL), The Simply Good Foods Company (NASDAQ:SMPL), Summit Materials Inc (NYSE:SUM), and Urban Edge Properties (NYSE:UE). This group of stocks’ market valuations are closest to VRRM’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SCL | 11 | 55727 | -5 |

| SMPL | 23 | 243876 | 1 |

| SUM | 22 | 557034 | 0 |

| UE | 12 | 121836 | -2 |

| Average | 17 | 244618 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17 hedge funds with bullish positions and the average amount invested in these stocks was $245 million. That figure was $174 million in VRRM’s case. The Simply Good Foods Company (NASDAQ:SMPL) is the most popular stock in this table. On the other hand Stepan Company (NYSE:SCL) is the least popular one with only 11 bullish hedge fund positions. Verra Mobility Corporation (NASDAQ:VRRM) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on VRRM as the stock returned 9.6% during the third quarter and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.