Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips or bumps on the charts, usually don’t make them change their opinion towards a company. This time it may be different. During the fourth quarter of 2018 we observed increased volatility and small-cap stocks underperformed the market. Things completely reversed during the first quarter. Hedge fund investor letters indicated that they are cutting their overall exposure, closing out some position and doubling down on others. Let’s take a look at the hedge fund sentiment towards Univar Inc (NYSE:UNVR) to find out whether it was one of their high conviction long-term ideas.

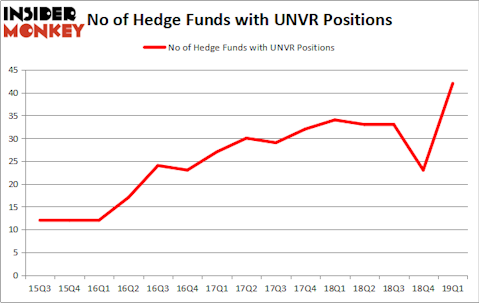

Univar Inc (NYSE:UNVR) has experienced an increase in activity from the world’s largest hedge funds in recent months. UNVR was in 42 hedge funds’ portfolios at the end of the first quarter of 2019. There were 23 hedge funds in our database with UNVR positions at the end of the previous quarter. Our calculations also showed that UNVR isn’t among the 30 most popular stocks among hedge funds.

According to most shareholders, hedge funds are assumed to be slow, old financial tools of yesteryear. While there are greater than 8000 funds in operation today, We hone in on the masters of this club, around 750 funds. These hedge fund managers handle most of the hedge fund industry’s total capital, and by monitoring their finest picks, Insider Monkey has deciphered a number of investment strategies that have historically defeated the broader indices. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by around 5 percentage points annually since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

We’re going to take a look at the fresh hedge fund action encompassing Univar Inc (NYSE:UNVR).

How have hedgies been trading Univar Inc (NYSE:UNVR)?

At Q1’s end, a total of 42 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 83% from the fourth quarter of 2018. The graph below displays the number of hedge funds with bullish position in UNVR over the last 15 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Baupost Group held the most valuable stake in Univar Inc (NYSE:UNVR), which was worth $210.5 million at the end of the first quarter. On the second spot was Longview Asset Management which amassed $195.5 million worth of shares. Moreover, First Pacific Advisors LLC, Glenview Capital, and Valinor Management were also bullish on Univar Inc (NYSE:UNVR), allocating a large percentage of their portfolios to this stock.

As aggregate interest increased, specific money managers were leading the bulls’ herd. First Pacific Advisors LLC, managed by Robert Rodriguez and Steven Romick, initiated the largest position in Univar Inc (NYSE:UNVR). First Pacific Advisors LLC had $172.5 million invested in the company at the end of the quarter. Larry Robbins’s Glenview Capital also made a $97.5 million investment in the stock during the quarter. The other funds with brand new UNVR positions are Ted White and Christopher Kiper’s Legion Partners Asset Management, Richard McGuire’s Marcato Capital Management, and Robert Emil Zoellner’s Alpine Associates.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Univar Inc (NYSE:UNVR) but similarly valued. These stocks are Penske Automotive Group, Inc. (NYSE:PAG), Graphic Packaging Holding Company (NYSE:GPK), The Brink’s Company (NYSE:BCO), and Selective Insurance Group, Inc. (NASDAQ:SIGI). This group of stocks’ market valuations resemble UNVR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PAG | 18 | 70927 | -5 |

| GPK | 24 | 639511 | 4 |

| BCO | 25 | 490686 | 3 |

| SIGI | 12 | 28810 | -2 |

| Average | 19.75 | 307484 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.75 hedge funds with bullish positions and the average amount invested in these stocks was $307 million. That figure was $1098 million in UNVR’s case. The Brink’s Company (NYSE:BCO) is the most popular stock in this table. On the other hand Selective Insurance Group, Inc. (NASDAQ:SIGI) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks Univar Inc (NYSE:UNVR) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately UNVR wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on UNVR were disappointed as the stock returned -5.9% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.