We at Insider Monkey have gone over 738 13F filings that hedge funds and famous value investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of March 31st. In this article we look at what those investors think of Tyler Technologies, Inc. (NYSE:TYL).

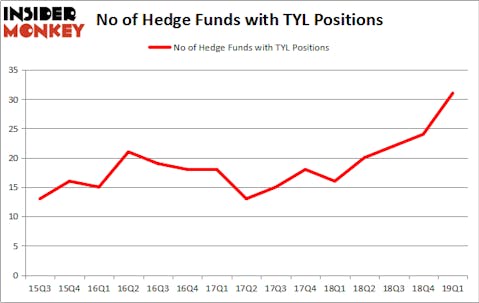

Tyler Technologies, Inc. (NYSE:TYL) has experienced an increase in support from the world’s most elite money managers lately. TYL was in 31 hedge funds’ portfolios at the end of March. There were 24 hedge funds in our database with TYL positions at the end of the previous quarter. Our calculations also showed that TYL isn’t among the 30 most popular stocks among hedge funds.

Today there are numerous metrics shareholders employ to grade their stock investments. A pair of the less known metrics are hedge fund and insider trading interest. Our experts have shown that, historically, those who follow the top picks of the top hedge fund managers can trounce the market by a very impressive amount (see the details here).

We’re going to take a look at the recent hedge fund action regarding Tyler Technologies, Inc. (NYSE:TYL).

Hedge fund activity in Tyler Technologies, Inc. (NYSE:TYL)

At the end of the first quarter, a total of 31 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 29% from the previous quarter. On the other hand, there were a total of 16 hedge funds with a bullish position in TYL a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Praesidium Investment Management Company, managed by Kevin Oram and Peter Uddo, holds the biggest position in Tyler Technologies, Inc. (NYSE:TYL). Praesidium Investment Management Company has a $123.4 million position in the stock, comprising 8.2% of its 13F portfolio. On Praesidium Investment Management Company’s heels is Sharlyn C. Heslam of Stockbridge Partners, with a $116.2 million position; 4.3% of its 13F portfolio is allocated to the stock. Remaining members of the smart money with similar optimism encompass Ryan Pedlow’s Two Creeks Capital Management, Robert G. Moses’s RGM Capital and Lou Simpson’s SQ Advisors.

As one would reasonably expect, key money managers were leading the bulls’ herd. Two Sigma Advisors, managed by John Overdeck and David Siegel, established the largest position in Tyler Technologies, Inc. (NYSE:TYL). Two Sigma Advisors had $9.3 million invested in the company at the end of the quarter. Benjamin A. Smith’s Laurion Capital Management also initiated a $1.8 million position during the quarter. The following funds were also among the new TYL investors: Michael Gelband’s ExodusPoint Capital, Matthew Tewksbury’s Stevens Capital Management, and Brandon Haley’s Holocene Advisors.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Tyler Technologies, Inc. (NYSE:TYL) but similarly valued. These stocks are Kimco Realty Corp (NYSE:KIM), Omega Healthcare Investors Inc (NYSE:OHI), Oaktree Capital Group LLC (NYSE:OAK), and ANGI Homeservices Inc. (NASDAQ:ANGI). This group of stocks’ market values are similar to TYL’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KIM | 11 | 71725 | -5 |

| OHI | 13 | 242355 | 2 |

| OAK | 15 | 201018 | 8 |

| ANGI | 22 | 402901 | 0 |

| Average | 15.25 | 229500 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.25 hedge funds with bullish positions and the average amount invested in these stocks was $229 million. That figure was $698 million in TYL’s case. ANGI Homeservices Inc. (NASDAQ:ANGI) is the most popular stock in this table. On the other hand Kimco Realty Corp (NYSE:KIM) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks Tyler Technologies, Inc. (NYSE:TYL) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on TYL as the stock returned 4.3% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.