At Insider Monkey, we pore over the filings of more than 700 top investment firms every quarter, a process we have now completed for the latest reporting period. The data we’ve gathered as a result gives us access to a wealth of collective knowledge based on these firms’ portfolio holdings as of September 30. In this article, we will use that wealth of knowledge to determine whether or not Tyler Technologies, Inc. (NYSE:TYL) makes for a good investment right now.

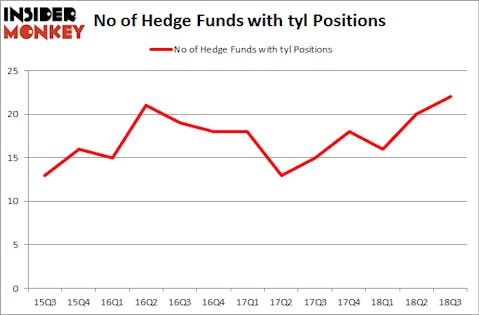

Tyler Technologies, Inc. (NYSE:TYL) shareholders have witnessed an increase in hedge fund interest in recent months. Our calculations also showed that tyl isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to go over the new hedge fund action regarding Tyler Technologies, Inc. (NYSE:TYL).

What does the smart money think about Tyler Technologies, Inc. (NYSE:TYL)?

At Q3’s end, a total of 22 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 10% from the previous quarter. On the other hand, there were a total of 18 hedge funds with a bullish position in TYL at the beginning of this year. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, SQ Advisors held the most valuable stake in Tyler Technologies, Inc. (NYSE:TYL), which was worth $206.8 million at the end of the third quarter. On the second spot was Praesidium Investment Management Company which amassed $134.6 million worth of shares. Moreover, Stockbridge Partners, RGM Capital, and Two Creeks Capital Management were also bullish on Tyler Technologies, Inc. (NYSE:TYL), allocating a large percentage of their portfolios to this stock.

With a general bullishness amongst the heavyweights, some big names have jumped into Tyler Technologies, Inc. (NYSE:TYL) headfirst. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, created the most valuable position in Tyler Technologies, Inc. (NYSE:TYL). Marshall Wace LLP had $5 million invested in the company at the end of the quarter. Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners also initiated a $3.5 million position during the quarter. The other funds with new positions in the stock are D. E. Shaw’s D E Shaw, Michael Platt and William Reeves’s BlueCrest Capital Mgmt., and Israel Englander’s Millennium Management.

Let’s also examine hedge fund activity in other stocks similar to Tyler Technologies, Inc. (NYSE:TYL). These stocks are Shaw Communications Inc (NYSE:SJR), Coty Inc (NYSE:COTY), Invesco Ltd. (NYSE:IVZ), and Huazhu Group Limited (NASDAQ:HTHT). All of these stocks’ market caps match TYL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SJR | 16 | 200046 | 3 |

| COTY | 24 | 286361 | 10 |

| IVZ | 27 | 283714 | 8 |

| HTHT | 14 | 41162 | -1 |

| Average | 20.25 | 202821 | 5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.25 hedge funds with bullish positions and the average amount invested in these stocks was $203 million. That figure was $752 million in TYL’s case. Invesco Ltd. (NYSE:IVZ) is the most popular stock in this table. On the other hand China Lodging Group, Limited (NASDAQ:HTHT) is the least popular one with only 14 bullish hedge fund positions. Tyler Technologies, Inc. (NYSE:TYL) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard IVZ might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.