The Insider Monkey team has completed processing the quarterly 13F filings for the March quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors experienced strong gains on the back of a strong market performance, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Twilio Inc. (NYSE:TWLO).

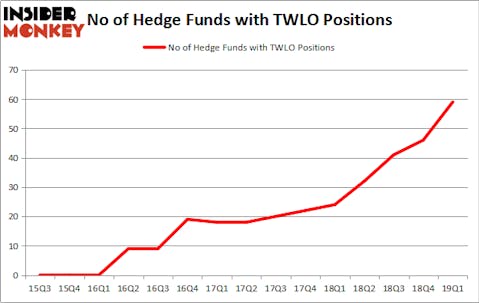

Twilio Inc. (NYSE:TWLO) was in 59 hedge funds’ portfolios at the end of the first quarter of 2019. TWLO has seen an increase in activity from the world’s largest hedge funds recently. There were 46 hedge funds in our database with TWLO holdings at the end of the previous quarter. Our calculations also showed that TWLO isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a multitude of formulas market participants put to use to grade stocks. Two of the most underrated formulas are hedge fund and insider trading indicators. We have shown that, historically, those who follow the best picks of the elite fund managers can outclass their index-focused peers by a healthy margin (see the details here).

We’re going to take a gander at the fresh hedge fund action encompassing Twilio Inc. (NYSE:TWLO).

How have hedgies been trading Twilio Inc. (NYSE:TWLO)?

Heading into the second quarter of 2019, a total of 59 of the hedge funds tracked by Insider Monkey were long this stock, a change of 28% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards TWLO over the last 15 quarters. With hedgies’ sentiment swirling, there exists a select group of key hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

The largest stake in Twilio Inc. (NYSE:TWLO) was held by Foxhaven Asset Management, which reported holding $322.1 million worth of stock at the end of March. It was followed by Whale Rock Capital Management with a $218.9 million position. Other investors bullish on the company included SCGE Management, Tybourne Capital Management, and Coatue Management.

As aggregate interest increased, key hedge funds were leading the bulls’ herd. Tybourne Capital Management, managed by Eashwar Krishnan, established the most outsized position in Twilio Inc. (NYSE:TWLO). Tybourne Capital Management had $202.9 million invested in the company at the end of the quarter. Chase Coleman’s Tiger Global Management also initiated a $135.6 million position during the quarter. The other funds with brand new TWLO positions are James Crichton’s Hitchwood Capital Management, Josh Donfeld and David Rogers’s Castle Hook Partners, and Michael Kahan and Jeremy Kahan’s North Peak Capital.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Twilio Inc. (NYSE:TWLO) but similarly valued. These stocks are Fortis Inc. (NYSE:FTS), Lennar Corporation (NYSE:LEN), KeyCorp (NYSE:KEY), and SK Telecom Co., Ltd. (NYSE:SKM). This group of stocks’ market values are similar to TWLO’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FTS | 13 | 231336 | -1 |

| LEN | 61 | 2310446 | -1 |

| KEY | 32 | 496942 | -1 |

| SKM | 6 | 73101 | 0 |

| Average | 28 | 777956 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28 hedge funds with bullish positions and the average amount invested in these stocks was $778 million. That figure was $2214 million in TWLO’s case. Lennar Corporation (NYSE:LEN) is the most popular stock in this table. On the other hand SK Telecom Co., Ltd. (NYSE:SKM) is the least popular one with only 6 bullish hedge fund positions. Twilio Inc. (NYSE:TWLO) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately TWLO wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on TWLO were disappointed as the stock returned -1.7% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.