Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of June. At Insider Monkey, we follow nearly 750 active hedge funds and notable investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is TCF Financial Corporation (NASDAQ:TCF), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

TCF Financial Corporation (NASDAQ:TCF) shareholders have witnessed an increase in hedge fund interest in recent months. Our calculations also showed that TCF isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a lot of indicators shareholders use to appraise stocks. Two of the most useful indicators are hedge fund and insider trading interest. Our experts have shown that, historically, those who follow the best picks of the top investment managers can trounce the S&P 500 by a superb margin (see the details here).

Dmitry Balyasny of Balyasny Asset Managemnet

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s take a look at the recent hedge fund action surrounding TCF Financial Corporation (NASDAQ:TCF).

How are hedge funds trading TCF Financial Corporation (NASDAQ:TCF)?

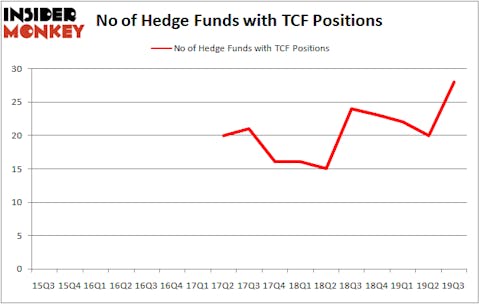

At Q3’s end, a total of 28 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 40% from the second quarter of 2019. The graph below displays the number of hedge funds with bullish position in TCF over the last 17 quarters. With hedgies’ sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Israel Englander’s Millennium Management has the biggest position in TCF Financial Corporation (NASDAQ:TCF), worth close to $85.8 million, amounting to 0.1% of its total 13F portfolio. On Millennium Management’s heels is Citadel Investment Group, led by Ken Griffin, holding a $74.9 million position; less than 0.1%% of its 13F portfolio is allocated to the stock. Some other hedge funds and institutional investors with similar optimism include Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Richard S. Pzena’s Pzena Investment Management and David E. Shaw’s D E Shaw. In terms of the portfolio weights assigned to each position Castine Capital Management allocated the biggest weight to TCF Financial Corporation (NASDAQ:TCF), around 5.23% of its portfolio. Azora Capital is also relatively very bullish on the stock, earmarking 4.38 percent of its 13F equity portfolio to TCF.

As aggregate interest increased, key hedge funds have been driving this bullishness. Azora Capital, managed by Ravi Chopra, assembled the most outsized position in TCF Financial Corporation (NASDAQ:TCF). Azora Capital had $19.8 million invested in the company at the end of the quarter. Paul Magidson, Jonathan Cohen. And Ostrom Enders’s Castine Capital Management also made a $19.1 million investment in the stock during the quarter. The following funds were also among the new TCF investors: Gregg Moskowitz’s Interval Partners, Dmitry Balyasny’s Balyasny Asset Management, and Noam Gottesman’s GLG Partners.

Let’s now review hedge fund activity in other stocks similar to TCF Financial Corporation (NASDAQ:TCF). We will take a look at GDS Holdings Limited (NASDAQ:GDS), Sonoco Products Company (NYSE:SON), CDK Global Inc (NASDAQ:CDK), and Enel Chile S.A. (NYSE:ENIC). This group of stocks’ market caps are similar to TCF’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GDS | 30 | 1126926 | 2 |

| SON | 20 | 117152 | 1 |

| CDK | 28 | 473046 | -1 |

| ENIC | 8 | 26016 | 2 |

| Average | 21.5 | 435785 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.5 hedge funds with bullish positions and the average amount invested in these stocks was $436 million. That figure was $359 million in TCF’s case. GDS Holdings Limited (NASDAQ:GDS) is the most popular stock in this table. On the other hand Enel Chile S.A. (NYSE:ENIC) is the least popular one with only 8 bullish hedge fund positions. TCF Financial Corporation (NASDAQ:TCF) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on TCF as the stock returned 12.5% during the fourth quarter (through the end of November) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.