Reputable billionaire investors such as Jim Simons, Cliff Asness and David Tepper generate exorbitant profits for their wealthy accredited investors (a minimum of $1 million in investable assets would be required to invest in a hedge fund and most successful hedge funds won’t accept your savings unless you commit at least $5 million) by pinpointing winning small-cap stocks. There is little or no publicly-available information at all on some of these small companies, which makes it hard for an individual investor to pin down a winner within the small-cap space. However, hedge funds and other big asset managers can do the due diligence and analysis for you instead, thanks to their highly-skilled research teams and vast resources to conduct an appropriate evaluation process. Looking for potential winners within the small-cap galaxy of stocks? We believe following the smart money is a good starting point.

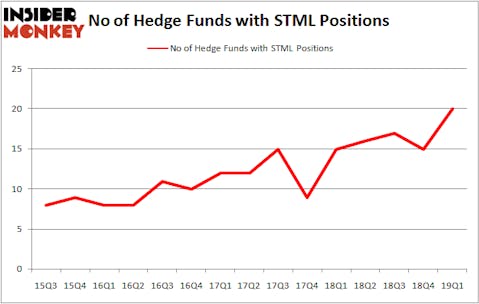

Stemline Therapeutics Inc (NASDAQ:STML) was in 20 hedge funds’ portfolios at the end of March. STML has experienced an increase in support from the world’s most elite money managers lately. There were 15 hedge funds in our database with STML positions at the end of the previous quarter. Our calculations also showed that STML isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a glance at the fresh hedge fund action encompassing Stemline Therapeutics Inc (NASDAQ:STML).

What does the smart money think about Stemline Therapeutics Inc (NASDAQ:STML)?

Heading into the second quarter of 2019, a total of 20 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 33% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in STML over the last 15 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Adage Capital Management, managed by Phill Gross and Robert Atchinson, holds the largest position in Stemline Therapeutics Inc (NASDAQ:STML). Adage Capital Management has a $45 million position in the stock, comprising 0.1% of its 13F portfolio. The second largest stake is held by Rubric Capital Management, led by David Rosen, holding a $38.6 million position; the fund has 3.6% of its 13F portfolio invested in the stock. Remaining professional money managers that hold long positions encompass Farallon Capital, Brian Ashford-Russell and Tim Woolley’s Polar Capital and Manoneet Singh’s Kavi Asset Management.

With a general bullishness amongst the heavyweights, specific money managers have jumped into Stemline Therapeutics Inc (NASDAQ:STML) headfirst. Rubric Capital Management, managed by David Rosen, assembled the largest position in Stemline Therapeutics Inc (NASDAQ:STML). Rubric Capital Management had $38.6 million invested in the company at the end of the quarter. Farallon Capital also made a $25.7 million investment in the stock during the quarter. The following funds were also among the new STML investors: Manoneet Singh’s Kavi Asset Management, Nathaniel August’s Mangrove Partners, and Noam Gottesman’s GLG Partners.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Stemline Therapeutics Inc (NASDAQ:STML) but similarly valued. We will take a look at HarborOne Bancorp, Inc. (NASDAQ:HONE), Ingles Markets, Incorporated (NASDAQ:IMKTA), Comtech Telecommunications Corp. (NASDAQ:CMTL), and Universal Logistics Holdings, Inc. (NASDAQ:ULH). This group of stocks’ market caps match STML’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HONE | 4 | 7730 | 0 |

| IMKTA | 11 | 43072 | 1 |

| CMTL | 20 | 90216 | 6 |

| ULH | 10 | 21608 | -1 |

| Average | 11.25 | 40657 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.25 hedge funds with bullish positions and the average amount invested in these stocks was $41 million. That figure was $189 million in STML’s case. Comtech Telecommunications Corp. (NASDAQ:CMTL) is the most popular stock in this table. On the other hand HarborOne Bancorp, Inc. (NASDAQ:HONE) is the least popular one with only 4 bullish hedge fund positions. Stemline Therapeutics Inc (NASDAQ:STML) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on STML as the stock returned 3.7% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.