Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 750 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ 2018 losses in Facebook and Apple. Let’s take a closer look at what the funds we track think about Solaredge Technologies Inc (NASDAQ:SEDG) in this article.

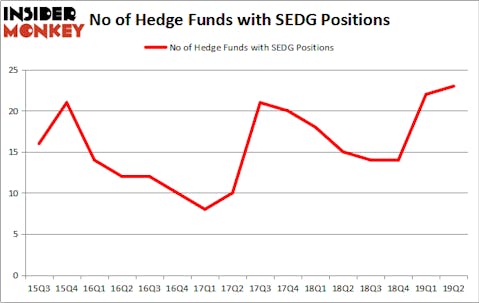

Is Solaredge Technologies Inc (NASDAQ:SEDG) a sound investment now? The best stock pickers are becoming more confident. The number of long hedge fund bets increased by 1 in recent months. Our calculations also showed that SEDG isn’t among the 30 most popular stocks among hedge funds (view video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a glance at the latest hedge fund action encompassing Solaredge Technologies Inc (NASDAQ:SEDG).

Hedge fund activity in Solaredge Technologies Inc (NASDAQ:SEDG)

Heading into the third quarter of 2019, a total of 23 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 5% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards SEDG over the last 16 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Solaredge Technologies Inc (NASDAQ:SEDG) was held by Noked Capital, which reported holding $38.6 million worth of stock at the end of March. It was followed by Rima Senvest Management with a $21.7 million position. Other investors bullish on the company included Renaissance Technologies, Citadel Investment Group, and Millennium Management.

With a general bullishness amongst the heavyweights, specific money managers were leading the bulls’ herd. Lakewood Capital Management, managed by Anthony Bozza, assembled the most valuable position in Solaredge Technologies Inc (NASDAQ:SEDG). Lakewood Capital Management had $10.3 million invested in the company at the end of the quarter. Richard Driehaus’s Driehaus Capital also made a $4.8 million investment in the stock during the quarter. The other funds with brand new SEDG positions are Brian Olson, Baehyun Sung, and Jamie Waters’s Blackstart Capital, Principal Global Investors’s Columbus Circle Investors, and Philip Hempleman’s Ardsley Partners.

Let’s also examine hedge fund activity in other stocks similar to Solaredge Technologies Inc (NASDAQ:SEDG). These stocks are Rattler Midstream LP (NASDAQ:RTLR), NIO Inc. (NYSE:NIO), Manchester United PLC (NYSE:MANU), and Iovance Biotherapeutics, Inc. (NASDAQ:IOVA). This group of stocks’ market caps resemble SEDG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RTLR | 20 | 217080 | 20 |

| NIO | 14 | 147419 | -7 |

| MANU | 10 | 41706 | -1 |

| IOVA | 22 | 1311346 | -3 |

| Average | 16.5 | 429388 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.5 hedge funds with bullish positions and the average amount invested in these stocks was $429 million. That figure was $146 million in SEDG’s case. Iovance Biotherapeutics, Inc. (NASDAQ:IOVA) is the most popular stock in this table. On the other hand Manchester United PLC (NYSE:MANU) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks Solaredge Technologies Inc (NASDAQ:SEDG) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on SEDG as the stock returned 34% during Q3 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.