Before we spend countless hours researching a company, we’d like to analyze what insiders, hedge funds and billionaire investors think of the stock first. We would like to do so because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Shoe Carnival, Inc. (NASDAQ:SCVL).

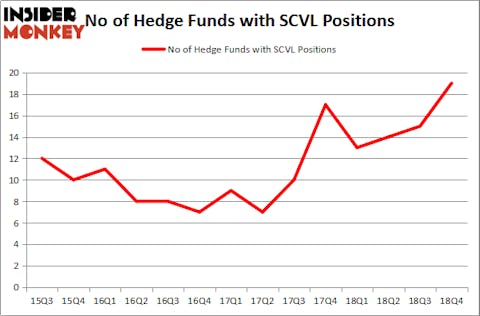

Is Shoe Carnival, Inc. (NASDAQ:SCVL) the right pick for your portfolio? The best stock pickers are becoming hopeful. The number of bullish hedge fund positions inched up by 4 lately. Our calculations also showed that SCVL isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are tons of metrics stock market investors have at their disposal to value stocks. A duo of the less known metrics are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the best picks of the top investment managers can beat the market by a superb margin (see the details here).

Let’s analyze the fresh hedge fund action encompassing Shoe Carnival, Inc. (NASDAQ:SCVL).

What does the smart money think about Shoe Carnival, Inc. (NASDAQ:SCVL)?

At the end of the fourth quarter, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 27% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards SCVL over the last 14 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were adding to their stakes significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Chuck Royce’s Royce & Associates has the most valuable position in Shoe Carnival, Inc. (NASDAQ:SCVL), worth close to $16.2 million, amounting to 0.1% of its total 13F portfolio. Coming in second is David Harding of Winton Capital Management, with a $11 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Other hedge funds and institutional investors that hold long positions encompass Cliff Asness’s AQR Capital Management, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital and D. E. Shaw’s D E Shaw.

As aggregate interest increased, specific money managers were leading the bulls’ herd. Winton Capital Management, managed by David Harding, created the biggest position in Shoe Carnival, Inc. (NASDAQ:SCVL). Winton Capital Management had $11 million invested in the company at the end of the quarter. Dmitry Balyasny’s Balyasny Asset Management also initiated a $4.5 million position during the quarter. The following funds were also among the new SCVL investors: Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital, Mike Vranos’s Ellington, and Hoon Kim’s Quantinno Capital.

Let’s also examine hedge fund activity in other stocks similar to Shoe Carnival, Inc. (NASDAQ:SCVL). We will take a look at Domo Inc. (NASDAQ:DOMO), Boston Omaha Corporation (NASDAQ:BOMN), Global Indemnity Limited (NASDAQ:GBLI), and Ribbon Communications Inc. (NASDAQ:RBBN). All of these stocks’ market caps resemble SCVL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DOMO | 13 | 76502 | -2 |

| BOMN | 4 | 168150 | 0 |

| GBLI | 5 | 43521 | -2 |

| RBBN | 15 | 31278 | 4 |

| Average | 9.25 | 79863 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.25 hedge funds with bullish positions and the average amount invested in these stocks was $80 million. That figure was $72 million in SCVL’s case. Ribbon Communications Inc. (NASDAQ:RBBN) is the most popular stock in this table. On the other hand Boston Omaha Corporation (NASDAQ:BOMN) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks Shoe Carnival, Inc. (NASDAQ:SCVL) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately SCVL wasn’t nearly as popular as these 15 stock and hedge funds that were betting on SCVL were disappointed as the stock returned 4.8% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.