A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended March 31, so let’s proceed with the discussion of the hedge fund sentiment on Science Applications International Corp (NYSE:SAIC).

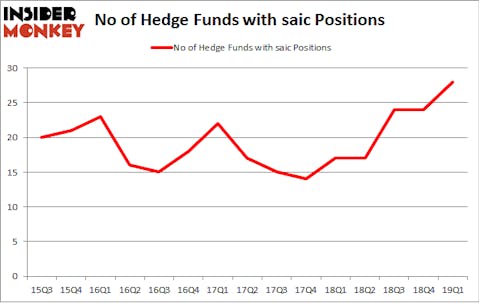

Is Science Applications International Corp (NYSE:SAIC) a buy right now? Investors who are in the know are turning bullish. The number of bullish hedge fund bets advanced by 4 in recent months. Our calculations also showed that saic isn’t among the 30 most popular stocks among hedge funds.

In today’s marketplace there are a large number of tools market participants use to size up publicly traded companies. A couple of the most innovative tools are hedge fund and insider trading signals. We have shown that, historically, those who follow the best picks of the elite money managers can outpace the S&P 500 by a superb margin (see the details here).

Cliff Asness of AQR Capital Management

Let’s view the new hedge fund action surrounding Science Applications International Corp (NYSE:SAIC).

What have hedge funds been doing with Science Applications International Corp (NYSE:SAIC)?

At the end of the first quarter, a total of 28 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 17% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards SAIC over the last 15 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Rubric Capital Management held the most valuable stake in Science Applications International Corp (NYSE:SAIC), which was worth $49.4 million at the end of the first quarter. On the second spot was Horizon Asset Management which amassed $41.4 million worth of shares. Moreover, Millennium Management, AQR Capital Management, and Citadel Investment Group were also bullish on Science Applications International Corp (NYSE:SAIC), allocating a large percentage of their portfolios to this stock.

Consequently, key hedge funds have been driving this bullishness. Rubric Capital Management, managed by David Rosen, established the most valuable position in Science Applications International Corp (NYSE:SAIC). Rubric Capital Management had $49.4 million invested in the company at the end of the quarter. Scott Kapnick’s HPS Investment Partners also made a $24.3 million investment in the stock during the quarter. The other funds with brand new SAIC positions are Jeffrey Jacobowitz’s Simcoe Capital Management, Richard S. Meisenberg’s ACK Asset Management, and Clint Carlson’s Carlson Capital.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Science Applications International Corp (NYSE:SAIC) but similarly valued. We will take a look at Americold Realty Trust (NYSE:COLD), Life Storage, Inc. (NYSE:LSI), MAXIMUS, Inc. (NYSE:MMS), and CACI International Inc (NYSE:CACI). This group of stocks’ market valuations match SAIC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| COLD | 27 | 907693 | 11 |

| LSI | 15 | 274431 | 2 |

| MMS | 20 | 288188 | -2 |

| CACI | 13 | 132826 | -5 |

| Average | 18.75 | 400785 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.75 hedge funds with bullish positions and the average amount invested in these stocks was $401 million. That figure was $356 million in SAIC’s case. Americold Realty Trust (NYSE:COLD) is the most popular stock in this table. On the other hand CACI International Inc (NYSE:CACI) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks Science Applications International Corp (NYSE:SAIC) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on SAIC, though not to the same extent, as the stock returned 1.4% during the same period and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.