At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Tiger Global because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

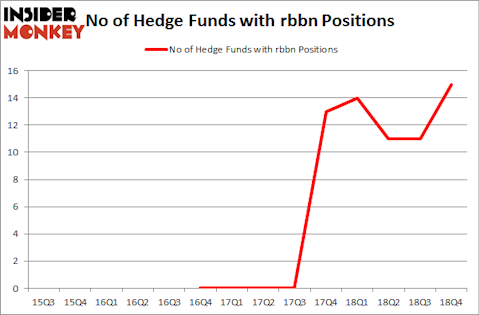

Is Ribbon Communications Inc. (NASDAQ:RBBN) worth your attention right now? Money managers are becoming more confident. The number of long hedge fund bets rose by 4 recently. Our calculations also showed that rbbn isn’t among the 30 most popular stocks among hedge funds.

At the moment there are a large number of tools stock market investors put to use to appraise publicly traded companies. Two of the most underrated tools are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the top picks of the top fund managers can outclass the S&P 500 by a solid margin (see the details here).

Arnaud Ajdler Engine Capital

We’re going to check out the recent hedge fund action encompassing Ribbon Communications Inc. (NASDAQ:RBBN).

How have hedgies been trading Ribbon Communications Inc. (NASDAQ:RBBN)?

At Q4’s end, a total of 15 of the hedge funds tracked by Insider Monkey were long this stock, a change of 36% from one quarter earlier. By comparison, 14 hedge funds held shares or bullish call options in RBBN a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Jim Simons’s Renaissance Technologies has the largest position in Ribbon Communications Inc. (NASDAQ:RBBN), worth close to $9.7 million, accounting for less than 0.1%% of its total 13F portfolio. Coming in second is Royce & Associates, managed by Chuck Royce, which holds a $9.5 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Other peers that are bullish contain D. E. Shaw’s D E Shaw, Arnaud Ajdler’s Engine Capital and Cliff Asness’s AQR Capital Management.

As one would reasonably expect, key hedge funds have jumped into Ribbon Communications Inc. (NASDAQ:RBBN) headfirst. G2 Investment Partners Management, managed by Josh Goldberg, created the most valuable position in Ribbon Communications Inc. (NASDAQ:RBBN). G2 Investment Partners Management had $1.2 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also made a $0.8 million investment in the stock during the quarter. The other funds with new positions in the stock are Roger Ibbotson’s Zebra Capital Management, Minhua Zhang’s Weld Capital Management, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s go over hedge fund activity in other stocks similar to Ribbon Communications Inc. (NASDAQ:RBBN). We will take a look at Universal Logistics Holdings, Inc. (NASDAQ:ULH), Casa Therapeutics Inc (NASDAQ:CARA), First Community Bankshares Inc (NASDAQ:FCBC), and National CineMedia, Inc. (NASDAQ:NCMI). This group of stocks’ market values are similar to RBBN’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ULH | 11 | 23418 | -1 |

| CARA | 9 | 17112 | -2 |

| FCBC | 3 | 8781 | -1 |

| NCMI | 19 | 30087 | 4 |

| Average | 10.5 | 19850 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.5 hedge funds with bullish positions and the average amount invested in these stocks was $20 million. That figure was $31 million in RBBN’s case. National CineMedia, Inc. (NASDAQ:NCMI) is the most popular stock in this table. On the other hand First Community Bankshares Inc (NASDAQ:FCBC) is the least popular one with only 3 bullish hedge fund positions. Ribbon Communications Inc. (NASDAQ:RBBN) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately RBBN wasn’t nearly as popular as these 15 stock and hedge funds that were betting on RBBN were disappointed as the stock returned 8.7% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.