In this article we will analyze whether RH (NYSE:RH) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, our research shows that these picks historically outperformed the market by double digits annually.

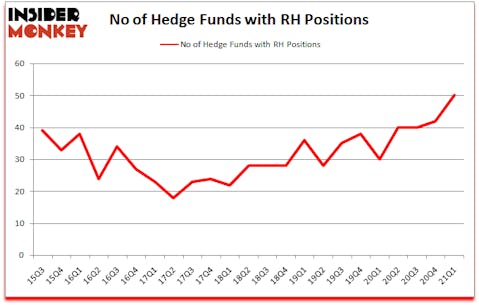

RH (NYSE:RH) has seen an increase in support from the world’s most elite money managers of late. RH (NYSE:RH) was in 50 hedge funds’ portfolios at the end of March. The all time high for this statistic was 42. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that RH isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings).

According to most investors, hedge funds are assumed to be unimportant, old financial vehicles of years past. While there are more than 8000 funds in operation today, We choose to focus on the upper echelon of this group, about 850 funds. It is estimated that this group of investors have their hands on most of all hedge funds’ total asset base, and by keeping track of their unrivaled picks, Insider Monkey has identified several investment strategies that have historically outstripped the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy outperformed the S&P 500 short ETFs by around 20 percentage points per year since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 206.8% since March 2017 (through May 2021) and beat the S&P 500 Index by more than 115 percentage points. You can download a sample issue of this newsletter on our website .

Warren Buffett of Berkshire Hathaway

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation, which is why we are checking out this inflation play. We go through lists like 10 best gold stocks to buy to identify promising stocks. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Now we’re going to take a gander at the fresh hedge fund action encompassing RH (NYSE:RH).

Do Hedge Funds Think RH Is A Good Stock To Buy Now?

At first quarter’s end, a total of 50 of the hedge funds tracked by Insider Monkey were long this stock, a change of 19% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in RH over the last 23 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Berkshire Hathaway was the largest shareholder of RH (NYSE:RH), with a stake worth $1047.9 million reported as of the end of March. Trailing Berkshire Hathaway was D1 Capital Partners, which amassed a stake valued at $451.3 million. Pelham Capital, Suvretta Capital Management, and Third Point were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Pelham Capital allocated the biggest weight to RH (NYSE:RH), around 11.99% of its 13F portfolio. Rip Road Capital is also relatively very bullish on the stock, designating 7.18 percent of its 13F equity portfolio to RH.

As one would reasonably expect, some big names have been driving this bullishness. Suvretta Capital Management, managed by Aaron Cowen, assembled the largest position in RH (NYSE:RH). Suvretta Capital Management had $186.2 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also made a $87.1 million investment in the stock during the quarter. The other funds with new positions in the stock are Alexander Mitchell’s Scopus Asset Management, Jonathan Auerbach’s Hound Partners, and Israel Englander’s Millennium Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as RH (NYSE:RH) but similarly valued. These stocks are Cna Financial Corporation (NYSE:CNA), Signature Bank (NASDAQ:SBNY), Graco Inc. (NYSE:GGG), Atmos Energy Corporation (NYSE:ATO), Chegg Inc (NYSE:CHGG), Annaly Capital Management, Inc. (NYSE:NLY), and Advance Auto Parts, Inc. (NYSE:AAP). This group of stocks’ market caps are closest to RH’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CNA | 19 | 74356 | 3 |

| SBNY | 40 | 925856 | 12 |

| GGG | 25 | 327418 | 0 |

| ATO | 15 | 172475 | -10 |

| CHGG | 33 | 672189 | 0 |

| NLY | 15 | 140155 | -6 |

| AAP | 43 | 1284543 | 7 |

| Average | 27.1 | 513856 | 0.9 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27.1 hedge funds with bullish positions and the average amount invested in these stocks was $514 million. That figure was $2992 million in RH’s case. Advance Auto Parts, Inc. (NYSE:AAP) is the most popular stock in this table. On the other hand Atmos Energy Corporation (NYSE:ATO) is the least popular one with only 15 bullish hedge fund positions. Compared to these stocks RH (NYSE:RH) is more popular among hedge funds. Our overall hedge fund sentiment score for RH is 90. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 17.4% in 2021 through June 18th and still managed to beat the market by 6.1 percentage points. Hedge funds were also right about betting on RH, though not to the same extent, as the stock returned 9.5% since the end of March (through June 18th) and outperformed the market as well.

Follow Rh (NYSE:RH)

Follow Rh (NYSE:RH)

Receive real-time insider trading and news alerts

Suggested Articles:

- How to Best Use Insider Monkey To Increase Your Returns

- 15 Cheapest Online Shopping Sites in USA

- 15 Largest Health Systems in the US

Disclosure: None. This article was originally published at Insider Monkey.