Most investors tend to think that hedge funds and other asset managers are worthless, as they cannot beat even simple index fund portfolios. In fact, most people expect hedge funds to compete with and outperform the bull market that we have witnessed in recent years. However, hedge funds are generally partially hedged and aim at delivering attractive risk-adjusted returns rather than following the ups and downs of equity markets hoping that they will outperform the broader market. Our research shows that certain hedge funds do have great stock picking skills (and we can identify these hedge funds in advance pretty accurately), so let’s take a glance at the smart money sentiment towards Rexford Industrial Realty Inc (NYSE:REXR).

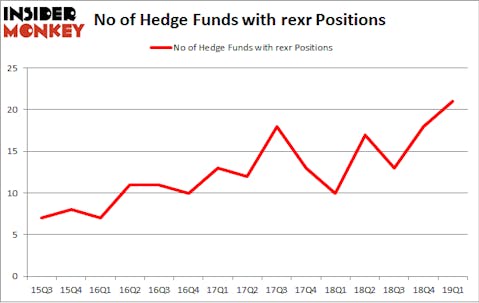

Rexford Industrial Realty Inc (NYSE:REXR) investors should be aware of an increase in hedge fund interest lately. REXR was in 21 hedge funds’ portfolios at the end of March. There were 18 hedge funds in our database with REXR positions at the end of the previous quarter. Our calculations also showed that rexr isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s analyze the key hedge fund action encompassing Rexford Industrial Realty Inc (NYSE:REXR).

What have hedge funds been doing with Rexford Industrial Realty Inc (NYSE:REXR)?

At the end of the first quarter, a total of 21 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 17% from the fourth quarter of 2018. On the other hand, there were a total of 10 hedge funds with a bullish position in REXR a year ago. With hedge funds’ capital changing hands, there exists an “upper tier” of notable hedge fund managers who were adding to their stakes considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, AEW Capital Management, managed by Jeffrey Furber, holds the number one position in Rexford Industrial Realty Inc (NYSE:REXR). AEW Capital Management has a $104.4 million position in the stock, comprising 3% of its 13F portfolio. Coming in second is Jim Simons of Renaissance Technologies, with a $65.4 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Some other members of the smart money that are bullish contain Clint Carlson’s Carlson Capital, Dmitry Balyasny’s Balyasny Asset Management and Israel Englander’s Millennium Management.

With a general bullishness amongst the heavyweights, specific money managers were breaking ground themselves. Two Sigma Advisors, managed by John Overdeck and David Siegel, initiated the biggest position in Rexford Industrial Realty Inc (NYSE:REXR). Two Sigma Advisors had $1.1 million invested in the company at the end of the quarter. Bruce Kovner’s Caxton Associates LP also initiated a $0.9 million position during the quarter. The following funds were also among the new REXR investors: Paul Tudor Jones’s Tudor Investment Corp, Thomas Bailard’s Bailard Inc, and Minhua Zhang’s Weld Capital Management.

Let’s check out hedge fund activity in other stocks similar to Rexford Industrial Realty Inc (NYSE:REXR). We will take a look at Coherent, Inc. (NASDAQ:COHR), F.N.B. Corp (NYSE:FNB), Ellie Mae Inc (NYSE:ELLI), and Thor Industries, Inc. (NYSE:THO). This group of stocks’ market values are similar to REXR’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| COHR | 14 | 201304 | -3 |

| FNB | 23 | 87087 | 3 |

| ELLI | 20 | 744697 | 2 |

| THO | 20 | 98141 | -2 |

| Average | 19.25 | 282807 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.25 hedge funds with bullish positions and the average amount invested in these stocks was $283 million. That figure was $264 million in REXR’s case. F.N.B. Corp (NYSE:FNB) is the most popular stock in this table. On the other hand Coherent, Inc. (NASDAQ:COHR) is the least popular one with only 14 bullish hedge fund positions. Rexford Industrial Realty Inc (NYSE:REXR) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on REXR as the stock returned 5.1% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.