Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips or bumps on the charts, usually don’t make them change their opinion towards a company. This time it may be different. During the fourth quarter of 2018 we observed increased volatility and a 20% drop in stock prices. Things completely reversed in 2019 and stock indices hit record highs. Recent hedge fund investor letters indicated that they are cutting their overall exposure, closing out some position and doubling down on others. Let’s take a look at the hedge fund sentiment towards Provention Bio, Inc. (NASDAQ:PRVB) to find out whether it was one of their high conviction long-term ideas.

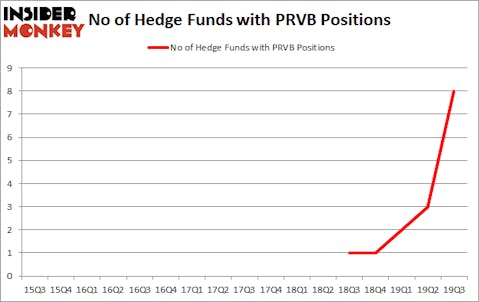

Provention Bio, Inc. (NASDAQ:PRVB) was in 8 hedge funds’ portfolios at the end of the third quarter of 2019. PRVB shareholders have witnessed an increase in support from the world’s most elite money managers of late. There were 3 hedge funds in our database with PRVB positions at the end of the previous quarter. Our calculations also showed that PRVB isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.8% through November 21, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

James E. Flynn of Deerfield Management

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. We’re going to take a glance at the new hedge fund action encompassing Provention Bio, Inc. (NASDAQ:PRVB).

What does smart money think about Provention Bio, Inc. (NASDAQ:PRVB)?

At the end of the third quarter, a total of 8 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 167% from the previous quarter. By comparison, 1 hedge funds held shares or bullish call options in PRVB a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Deerfield Management was the largest shareholder of Provention Bio, Inc. (NASDAQ:PRVB), with a stake worth $4.9 million reported as of the end of September. Trailing Deerfield Management was Segantii Capital, which amassed a stake valued at $4.9 million. Perceptive Advisors, Bailard Inc, and ExodusPoint Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Segantii Capital allocated the biggest weight to Provention Bio, Inc. (NASDAQ:PRVB), around 0.67% of its 13F portfolio. Deerfield Management is also relatively very bullish on the stock, setting aside 0.2 percent of its 13F equity portfolio to PRVB.

As one would reasonably expect, some big names were breaking ground themselves. Deerfield Management, managed by James E. Flynn, assembled the largest position in Provention Bio, Inc. (NASDAQ:PRVB). Deerfield Management had $4.9 million invested in the company at the end of the quarter. Simon Sadler’s Segantii Capital also made a $4.9 million investment in the stock during the quarter. The other funds with new positions in the stock are Joseph Edelman’s Perceptive Advisors, Michael Gelband’s ExodusPoint Capital, and Israel Englander’s Millennium Management.

Let’s check out hedge fund activity in other stocks similar to Provention Bio, Inc. (NASDAQ:PRVB). We will take a look at Cedar Realty Trust Inc (NYSE:CDR), Greenhill & Co., Inc. (NYSE:GHL), Pfenex Inc (NYSE:PFNX), and RR Donnelley & Sons Company (NASDAQ:RRD). This group of stocks’ market caps are closest to PRVB’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CDR | 10 | 16965 | -3 |

| GHL | 11 | 21075 | 0 |

| PFNX | 14 | 35852 | 2 |

| RRD | 15 | 15735 | 3 |

| Average | 12.5 | 22407 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.5 hedge funds with bullish positions and the average amount invested in these stocks was $22 million. That figure was $15 million in PRVB’s case. RR Donnelley & Sons Company (NASDAQ:RRD) is the most popular stock in this table. On the other hand Cedar Realty Trust Inc (NYSE:CDR) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks Provention Bio, Inc. (NASDAQ:PRVB) is even less popular than CDR. Hedge funds clearly dropped the ball on PRVB as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on PRVB as the stock returned 45.9% during the fourth quarter (through the end of November) and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.