We can judge whether ProPetro Holding Corp. (NYSE:PUMP) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, our research shows that these picks historically outperformed the market when we factor in known risk factors.

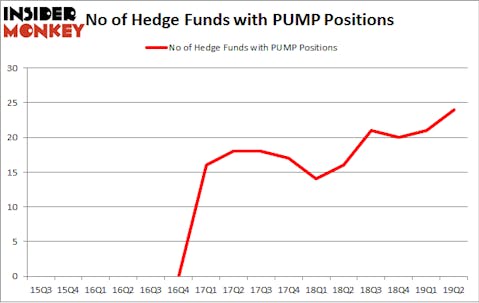

ProPetro Holding Corp. (NYSE:PUMP) was in 24 hedge funds’ portfolios at the end of June. PUMP shareholders have witnessed an increase in activity from the world’s largest hedge funds of late. There were 21 hedge funds in our database with PUMP holdings at the end of the previous quarter. Our calculations also showed that PUMP isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are several methods investors employ to analyze their holdings. A duo of the less utilized methods are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the top picks of the best fund managers can beat the S&P 500 by a very impressive margin (see the details here).

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a gander at the key hedge fund action regarding ProPetro Holding Corp. (NYSE:PUMP).

What have hedge funds been doing with ProPetro Holding Corp. (NYSE:PUMP)?

At the end of the second quarter, a total of 24 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 14% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in PUMP over the last 16 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Fisher Asset Management, managed by Ken Fisher, holds the number one position in ProPetro Holding Corp. (NYSE:PUMP). Fisher Asset Management has a $50.2 million position in the stock, comprising 0.1% of its 13F portfolio. On Fisher Asset Management’s heels is Israel Englander of Millennium Management, with a $33.5 million position; 0.1% of its 13F portfolio is allocated to the stock. Remaining hedge funds and institutional investors that hold long positions include Phill Gross and Robert Atchinson’s Adage Capital Management, Todd J. Kantor’s Encompass Capital Advisors and Robert Polak’s Anchor Bolt Capital.

As aggregate interest increased, some big names have been driving this bullishness. Renaissance Technologies created the most valuable position in ProPetro Holding Corp. (NYSE:PUMP). Renaissance Technologies had $4.3 million invested in the company at the end of the quarter. D. E. Shaw’s D E Shaw also made a $3.9 million investment in the stock during the quarter. The following funds were also among the new PUMP investors: Alexander Mitchell’s Scopus Asset Management, Cliff Asness’s AQR Capital Management, and Steve Cohen’s Point72 Asset Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as ProPetro Holding Corp. (NYSE:PUMP) but similarly valued. We will take a look at Wageworks Inc (NYSE:WAGE), Conduent Incorporated (NYSE:CNDT), Meritage Homes Corporation (NYSE:MTH), and Inter Parfums, Inc. (NASDAQ:IPAR). This group of stocks’ market values match PUMP’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WAGE | 21 | 254378 | 0 |

| CNDT | 27 | 591464 | -3 |

| MTH | 15 | 191125 | 1 |

| IPAR | 17 | 92111 | -5 |

| Average | 20 | 282270 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20 hedge funds with bullish positions and the average amount invested in these stocks was $282 million. That figure was $206 million in PUMP’s case. Conduent Incorporated (NYSE:CNDT) is the most popular stock in this table. On the other hand Meritage Homes Corporation (NYSE:MTH) is the least popular one with only 15 bullish hedge fund positions. ProPetro Holding Corp. (NYSE:PUMP) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately PUMP wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on PUMP were disappointed as the stock returned -56.1% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.