Most investors tend to think that hedge funds and other asset managers are worthless, as they cannot beat even simple index fund portfolios. In fact, most people expect hedge funds to compete with and outperform the bull market that we have witnessed in recent years. However, hedge funds are generally partially hedged and aim at delivering attractive risk-adjusted returns rather than following the ups and downs of equity markets hoping that they will outperform the broader market. Our research shows that certain hedge funds do have great stock picking skills (and we can identify these hedge funds in advance pretty accurately), so let’s take a glance at the smart money sentiment towards Pacific Biosciences of California, Inc. (NASDAQ:PACB).

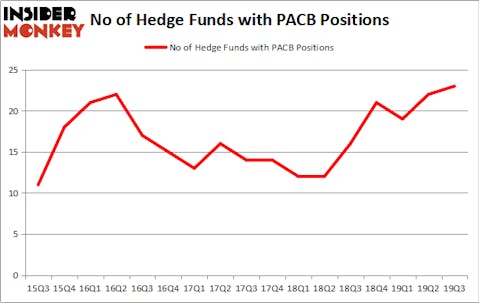

Pacific Biosciences of California, Inc. (NASDAQ:PACB) has experienced an increase in enthusiasm from smart money lately. PACB was in 23 hedge funds’ portfolios at the end of September. There were 22 hedge funds in our database with PACB positions at the end of the previous quarter. Our calculations also showed that PACB isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in stocks that are in our short portfolio.

Noam Gottesman of GLG Partners

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to check out the key hedge fund action encompassing Pacific Biosciences of California, Inc. (NASDAQ:PACB).

What does smart money think about Pacific Biosciences of California, Inc. (NASDAQ:PACB)?

At Q3’s end, a total of 23 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 5% from the second quarter of 2019. The graph below displays the number of hedge funds with bullish position in PACB over the last 17 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Pacific Biosciences of California, Inc. (NASDAQ:PACB) was held by Magnetar Capital, which reported holding $36.5 million worth of stock at the end of September. It was followed by Alpine Associates with a $28.4 million position. Other investors bullish on the company included Water Island Capital, Millennium Management, and GLG Partners. In terms of the portfolio weights assigned to each position Havens Advisors allocated the biggest weight to Pacific Biosciences of California, Inc. (NASDAQ:PACB), around 2.72% of its 13F portfolio. Water Island Capital is also relatively very bullish on the stock, earmarking 1.47 percent of its 13F equity portfolio to PACB.

Now, key money managers were breaking ground themselves. Alyeska Investment Group, managed by Anand Parekh, assembled the most valuable position in Pacific Biosciences of California, Inc. (NASDAQ:PACB). Alyeska Investment Group had $6.6 million invested in the company at the end of the quarter. Andrew Hahn’s Ursa Fund Management also initiated a $1 million position during the quarter. The other funds with new positions in the stock are Michael Platt and William Reeves’s BlueCrest Capital Mgmt. and Michael Gelband’s ExodusPoint Capital.

Let’s also examine hedge fund activity in other stocks similar to Pacific Biosciences of California, Inc. (NASDAQ:PACB). We will take a look at INTL Fcstone Inc (NASDAQ:INTL), Ingles Markets, Incorporated (NASDAQ:IMKTA), Celestica Inc. (NYSE:CLS), and ConnectOne Bancorp Inc (NASDAQ:CNOB). All of these stocks’ market caps resemble PACB’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| INTL | 10 | 92507 | -1 |

| IMKTA | 12 | 59791 | -1 |

| CLS | 13 | 69373 | 1 |

| CNOB | 12 | 48484 | 3 |

| Average | 11.75 | 67539 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.75 hedge funds with bullish positions and the average amount invested in these stocks was $68 million. That figure was $132 million in PACB’s case. Celestica Inc. (NYSE:CLS) is the most popular stock in this table. On the other hand INTL Fcstone Inc (NASDAQ:INTL) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks Pacific Biosciences of California, Inc. (NASDAQ:PACB) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately PACB wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on PACB were disappointed as the stock returned -0.4% during the first two months of the fourth quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.