We are still in an overall bull market and many stocks that smart money investors were piling into surged through October 17th. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 45% and 39% respectively. Hedge funds’ top 3 stock picks returned 34.4% this year and beat the S&P 500 ETFs by 13 percentage points. That’s a big deal.This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

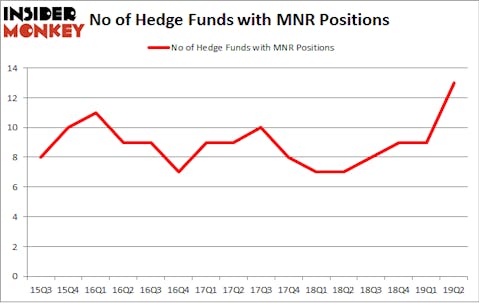

Is Monmouth Real Estate Investment Corporation (NYSE:MNR) a buy right now? Hedge funds are becoming more confident. The number of long hedge fund bets improved by 4 recently. Our calculations also showed that MNR isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To most traders, hedge funds are seen as worthless, old financial vehicles of years past. While there are more than 8000 funds with their doors open at present, We look at the moguls of this group, about 750 funds. It is estimated that this group of investors administer bulk of the smart money’s total asset base, and by monitoring their matchless stock picks, Insider Monkey has identified several investment strategies that have historically outperformed the market. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by around 5 percentage points per year since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s view the new hedge fund action surrounding Monmouth Real Estate Investment Corporation (NYSE:MNR).

How are hedge funds trading Monmouth Real Estate Investment Corporation (NYSE:MNR)?

At the end of the second quarter, a total of 13 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 44% from the first quarter of 2019. On the other hand, there were a total of 7 hedge funds with a bullish position in MNR a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Renaissance Technologies was the largest shareholder of Monmouth Real Estate Investment Corporation (NYSE:MNR), with a stake worth $35.5 million reported as of the end of March. Trailing Renaissance Technologies was Millennium Management, which amassed a stake valued at $9.2 million. Two Sigma Advisors, Citadel Investment Group, and Balyasny Asset Management were also very fond of the stock, giving the stock large weights in their portfolios.

As aggregate interest increased, key hedge funds were leading the bulls’ herd. GAMCO Investors, managed by Mario Gabelli, created the largest position in Monmouth Real Estate Investment Corporation (NYSE:MNR). GAMCO Investors had $1.5 million invested in the company at the end of the quarter. Matthew Tewksbury’s Stevens Capital Management also initiated a $0.6 million position during the quarter. The other funds with brand new MNR positions are Paul Marshall and Ian Wace’s Marshall Wace LLP, Paul Tudor Jones’s Tudor Investment Corp, and Ken Griffin’s Citadel Investment Group.

Let’s also examine hedge fund activity in other stocks similar to Monmouth Real Estate Investment Corporation (NYSE:MNR). These stocks are Ferro Corporation (NYSE:FOE), Gibraltar Industries Inc (NASDAQ:ROCK), Cardtronics plc (NASDAQ:CATM), and Hovnanian Enterprises, Inc. (NYSE:HOV). This group of stocks’ market values are closest to MNR’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FOE | 14 | 155533 | -2 |

| ROCK | 10 | 95650 | -4 |

| CATM | 19 | 331653 | 1 |

| HOV | 3 | 2686 | 0 |

| Average | 11.5 | 146381 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.5 hedge funds with bullish positions and the average amount invested in these stocks was $146 million. That figure was $62 million in MNR’s case. Cardtronics plc (NASDAQ:CATM) is the most popular stock in this table. On the other hand Hovnanian Enterprises, Inc. (NYSE:HOV) is the least popular one with only 3 bullish hedge fund positions. Monmouth Real Estate Investment Corporation (NYSE:MNR) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on MNR as the stock returned 7.7% during the third quarter and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.