Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of September. At Insider Monkey, we follow nearly 900 active hedge funds and notable investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is Monmouth Real Estate Investment Corp. (NYSE:MNR), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

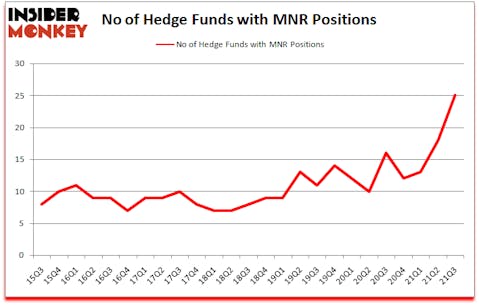

Monmouth Real Estate Investment Corp. (NYSE:MNR) has experienced an increase in enthusiasm from smart money recently. Monmouth Real Estate Investment Corp. (NYSE:MNR) was in 25 hedge funds’ portfolios at the end of the third quarter of 2021. The all time high for this statistic was previously 18. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that MNR isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings).

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Keeping this in mind let’s analyze the recent hedge fund action encompassing Monmouth Real Estate Investment Corp. (NYSE:MNR).

Phillip Goldstein of Bulldog Investors

Do Hedge Funds Think MNR Is A Good Stock To Buy Now?

At Q3’s end, a total of 25 of the hedge funds tracked by Insider Monkey were long this stock, a change of 39% from one quarter earlier. On the other hand, there were a total of 16 hedge funds with a bullish position in MNR a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Millennium Management held the most valuable stake in Monmouth Real Estate Investment Corp. (NYSE:MNR), which was worth $43.1 million at the end of the third quarter. On the second spot was Pentwater Capital Management which amassed $41 million worth of shares. Water Island Capital, Renaissance Technologies, and Alpine Associates were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position BCK Capital allocated the biggest weight to Monmouth Real Estate Investment Corp. (NYSE:MNR), around 3.55% of its 13F portfolio. Water Island Capital is also relatively very bullish on the stock, dishing out 2.26 percent of its 13F equity portfolio to MNR.

Consequently, key hedge funds were breaking ground themselves. Pentwater Capital Management, managed by Matthew Halbower, created the most outsized position in Monmouth Real Estate Investment Corp. (NYSE:MNR). Pentwater Capital Management had $41 million invested in the company at the end of the quarter. Robert Emil Zoellner’s Alpine Associates also initiated a $17.3 million position during the quarter. The following funds were also among the new MNR investors: Paul Glazer’s Glazer Capital, David Alexander Witkin’s Beryl Capital Management, and Phillip Goldstein, Andrew Dakos and Steven Samuels’s Bulldog Investors.

Let’s now review hedge fund activity in other stocks similar to Monmouth Real Estate Investment Corp. (NYSE:MNR). These stocks are Jumia Technologies AG (NYSE:JMIA), YPF Sociedad Anonima (NYSE:YPF), Organogenesis Holdings Inc. (NASDAQ:ORGO), Provident Financial Services, Inc. (NYSE:PFS), AssetMark Financial Holdings, Inc. (NYSE:AMK), Compass Diversified (NYSE:CODI), and Spire Global Inc. (NYSE:SPIR). This group of stocks’ market values are closest to MNR’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| JMIA | 14 | 58492 | 0 |

| YPF | 7 | 23880 | -4 |

| ORGO | 14 | 164978 | -2 |

| PFS | 5 | 7523 | -2 |

| AMK | 10 | 64887 | 1 |

| CODI | 8 | 43084 | 4 |

| SPIR | 17 | 176857 | -10 |

| Average | 10.7 | 77100 | -1.9 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.7 hedge funds with bullish positions and the average amount invested in these stocks was $77 million. That figure was $214 million in MNR’s case. Spire Global Inc. (NYSE:SPIR) is the most popular stock in this table. On the other hand Provident Financial Services, Inc. (NYSE:PFS) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks Monmouth Real Estate Investment Corp. (NYSE:MNR) is more popular among hedge funds. Our overall hedge fund sentiment score for MNR is 90. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks returned 31.1% in 2021 through December 9th but still managed to beat the market by 5.1 percentage points. Hedge funds were also right about betting on MNR as the stock returned 13.1% since the end of September (through 12/9) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Monmouth Real Estate Investment Corp (NYSE:MNR)

Follow Monmouth Real Estate Investment Corp (NYSE:MNR)

Receive real-time insider trading and news alerts

Suggested Articles:

- 15 Biggest Petrochemical Companies In The World

- 10 Best Auto Stocks to Buy Now

- 10 Fastest Growing Franchises in the US

Disclosure: None. This article was originally published at Insider Monkey.