How do we determine whether Momenta Pharmaceuticals, Inc. (NASDAQ:MNTA) makes for a good investment at the moment? We analyze the sentiment of a select group of the very best investors in the world, who spend immense amounts of time and resources studying companies. They may not always be right (no one is), but data shows that their consensus long positions have historically outperformed the market when we adjust for known risk factors.

Momenta Pharmaceuticals, Inc. (NASDAQ:MNTA) has seen an increase in support from the world’s most elite money managers in recent months. Our calculations also showed that mnta isn’t among the 30 most popular stocks among hedge funds.

Today there are many tools market participants use to evaluate stocks. A duo of the most under-the-radar tools are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the best picks of the elite hedge fund managers can beat the market by a significant margin (see the details here).

We’re going to check out the fresh hedge fund action encompassing Momenta Pharmaceuticals, Inc. (NASDAQ:MNTA).

How are hedge funds trading Momenta Pharmaceuticals, Inc. (NASDAQ:MNTA)?

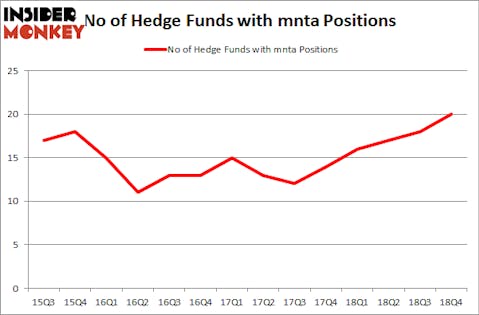

At the end of the fourth quarter, a total of 20 of the hedge funds tracked by Insider Monkey were long this stock, a change of 11% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in MNTA over the last 14 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were adding to their stakes meaningfully (or already accumulated large positions).

Among these funds, Camber Capital Management held the most valuable stake in Momenta Pharmaceuticals, Inc. (NASDAQ:MNTA), which was worth $44.2 million at the end of the fourth quarter. On the second spot was Perceptive Advisors which amassed $31.1 million worth of shares. Moreover, D E Shaw, RA Capital Management, and Palo Alto Investors were also bullish on Momenta Pharmaceuticals, Inc. (NASDAQ:MNTA), allocating a large percentage of their portfolios to this stock.

As aggregate interest increased, specific money managers were breaking ground themselves. Ghost Tree Capital, managed by Ken Greenberg and David Kim, initiated the most outsized position in Momenta Pharmaceuticals, Inc. (NASDAQ:MNTA). Ghost Tree Capital had $3.6 million invested in the company at the end of the quarter. Benjamin A. Smith’s Laurion Capital Management also made a $2.5 million investment in the stock during the quarter. The following funds were also among the new MNTA investors: Paul Marshall and Ian Wace’s Marshall Wace LLP, Minhua Zhang’s Weld Capital Management, and Ken Griffin’s Citadel Investment Group.

Let’s now review hedge fund activity in other stocks similar to Momenta Pharmaceuticals, Inc. (NASDAQ:MNTA). We will take a look at Arbor Realty Trust, Inc. (NYSE:ABR), Rent-A-Center Inc (NASDAQ:RCII), Enterprise Financial Services Corp (NASDAQ:EFSC), and Social Capital Hedosophia Holdings Corp. (NYSE:IPOA). This group of stocks’ market values resemble MNTA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ABR | 15 | 21089 | 5 |

| RCII | 19 | 249791 | 2 |

| EFSC | 15 | 53093 | 2 |

| IPOA | 21 | 288648 | -2 |

| Average | 17.5 | 153155 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.5 hedge funds with bullish positions and the average amount invested in these stocks was $153 million. That figure was $196 million in MNTA’s case. Social Capital Hedosophia Holdings Corp. (NYSE:IPOA) is the most popular stock in this table. On the other hand Arbor Realty Trust, Inc. (NYSE:ABR) is the least popular one with only 15 bullish hedge fund positions. Momenta Pharmaceuticals, Inc. (NASDAQ:MNTA) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on MNTA as the stock returned 30.9% and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.