Before we spend countless hours researching a company, we’d like to analyze what insiders, hedge funds and billionaire investors think of the stock first. We would like to do so because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Matrix Service Co (NASDAQ:MTRX).

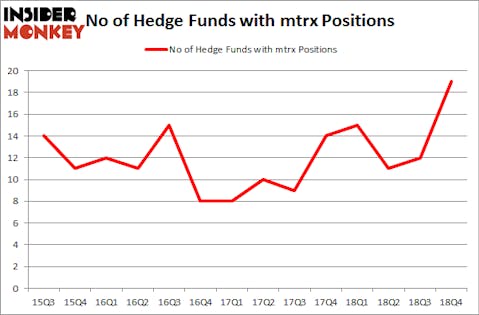

Is Matrix Service Co (NASDAQ:MTRX) going to take off soon? Investors who are in the know are becoming hopeful. The number of long hedge fund positions improved by 7 recently. Our calculations also showed that mtrx isn’t among the 30 most popular stocks among hedge funds. MTRX was in 19 hedge funds’ portfolios at the end of December. There were 12 hedge funds in our database with MTRX positions at the end of the previous quarter.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Noam Gottesman, GLG Partners

Let’s view the new hedge fund action regarding Matrix Service Co (NASDAQ:MTRX).

What does the smart money think about Matrix Service Co (NASDAQ:MTRX)?

At the end of the fourth quarter, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 58% from one quarter earlier. By comparison, 15 hedge funds held shares or bullish call options in MTRX a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Royce & Associates, managed by Chuck Royce, holds the most valuable position in Matrix Service Co (NASDAQ:MTRX). Royce & Associates has a $8.3 million position in the stock, comprising 0.1% of its 13F portfolio. Coming in second is AQR Capital Management, led by Cliff Asness, holding a $8 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Some other peers that hold long positions consist of Noam Gottesman’s GLG Partners, Peter Schliemann’s Rutabaga Capital Management and D. E. Shaw’s D E Shaw.

With a general bullishness amongst the heavyweights, key money managers were leading the bulls’ herd. Blue Mountain Capital, managed by Andrew Feldstein and Stephen Siderow, assembled the biggest position in Matrix Service Co (NASDAQ:MTRX). Blue Mountain Capital had $0.8 million invested in the company at the end of the quarter. Peter Algert and Kevin Coldiron’s Algert Coldiron Investors also initiated a $0.6 million position during the quarter. The other funds with brand new MTRX positions are Minhua Zhang’s Weld Capital Management, Paul Tudor Jones’s Tudor Investment Corp, and Peter Muller’s PDT Partners.

Let’s now take a look at hedge fund activity in other stocks similar to Matrix Service Co (NASDAQ:MTRX). These stocks are RISE Education Cayman Ltd (NASDAQ:REDU), Mobileiron Inc (NASDAQ:MOBL), Peapack-Gladstone Financial Corp (NASDAQ:PGC), and Sierra Wireless, Inc. (NASDAQ:SWIR). All of these stocks’ market caps are similar to MTRX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| REDU | 4 | 8795 | -1 |

| MOBL | 16 | 93695 | 4 |

| PGC | 15 | 76314 | 0 |

| SWIR | 10 | 38469 | 2 |

| Average | 11.25 | 54318 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.25 hedge funds with bullish positions and the average amount invested in these stocks was $54 million. That figure was $46 million in MTRX’s case. Mobileiron Inc (NASDAQ:MOBL) is the most popular stock in this table. On the other hand RISE Education Cayman Ltd (NASDAQ:REDU) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks Matrix Service Co (NASDAQ:MTRX) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately MTRX wasn’t nearly as popular as these 15 stock and hedge funds that were betting on MTRX were disappointed as the stock returned 11.6% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.