Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in LivePerson, Inc. (NASDAQ:LPSN)? The smart money sentiment can provide an answer to this question.

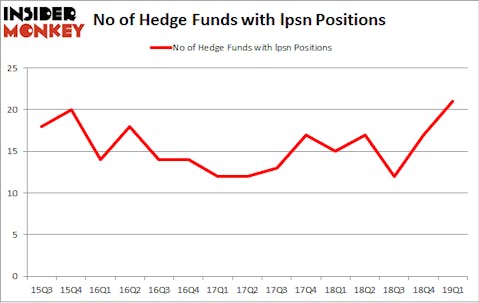

LivePerson, Inc. (NASDAQ:LPSN) investors should be aware of an increase in support from the world’s most elite money managers of late. Our calculations also showed that lpsn isn’t among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are plenty of formulas stock traders use to evaluate stocks. A couple of the less known formulas are hedge fund and insider trading activity. Our researchers have shown that, historically, those who follow the top picks of the elite money managers can outperform the S&P 500 by a very impressive margin (see the details here).

Let’s take a look at the key hedge fund action surrounding LivePerson, Inc. (NASDAQ:LPSN).

What does the smart money think about LivePerson, Inc. (NASDAQ:LPSN)?

Heading into the second quarter of 2019, a total of 21 of the hedge funds tracked by Insider Monkey were long this stock, a change of 24% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards LPSN over the last 15 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, RGM Capital was the largest shareholder of LivePerson, Inc. (NASDAQ:LPSN), with a stake worth $67.7 million reported as of the end of March. Trailing RGM Capital was Polar Capital, which amassed a stake valued at $35.4 million. Renaissance Technologies, Portolan Capital Management, and Arrowstreet Capital were also very fond of the stock, giving the stock large weights in their portfolios.

Consequently, some big names have been driving this bullishness. Polar Capital, managed by Brian Ashford-Russell and Tim Woolley, assembled the most outsized position in LivePerson, Inc. (NASDAQ:LPSN). Polar Capital had $35.4 million invested in the company at the end of the quarter. Ira Unschuld’s Brant Point Investment Management also made a $7.8 million investment in the stock during the quarter. The other funds with brand new LPSN positions are Mark N. Diker’s Diker Management, Nick Niell’s Arrowgrass Capital Partners, and Andrew Weiss’s Weiss Asset Management.

Let’s go over hedge fund activity in other stocks similar to LivePerson, Inc. (NASDAQ:LPSN). We will take a look at Compass Minerals International, Inc. (NYSE:CMP), QEP Resources Inc (NYSE:QEP), Atara Biotherapeutics Inc (NASDAQ:ATRA), and Redfin Corporation (NASDAQ:RDFN). All of these stocks’ market caps are similar to LPSN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CMP | 13 | 100028 | 1 |

| QEP | 23 | 291990 | -2 |

| ATRA | 15 | 672346 | 4 |

| RDFN | 8 | 177016 | 1 |

| Average | 14.75 | 310345 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.75 hedge funds with bullish positions and the average amount invested in these stocks was $310 million. That figure was $239 million in LPSN’s case. QEP Resources Inc (NYSE:QEP) is the most popular stock in this table. On the other hand Redfin Corporation (NASDAQ:RDFN) is the least popular one with only 8 bullish hedge fund positions. LivePerson, Inc. (NASDAQ:LPSN) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately LPSN wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on LPSN were disappointed as the stock returned -3% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.