Is LivePerson, Inc. (NASDAQ:LPSN) a good bet right now? We like to analyze hedge fund sentiment before doing days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy league graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

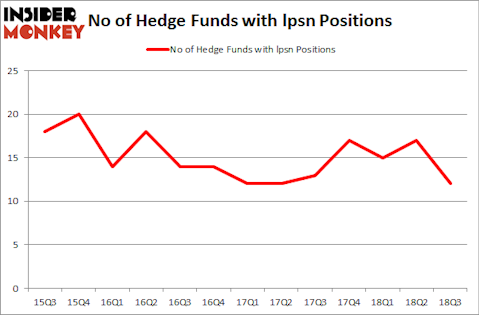

Is LivePerson, Inc. (NASDAQ:LPSN) a bargain? Prominent investors are taking a bearish view. The number of bullish hedge fund bets went down by 5 in recent months. Our calculations also showed that lpsn isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most shareholders, hedge funds are perceived as unimportant, old financial tools of yesteryear. While there are over 8,000 funds with their doors open at the moment, We hone in on the leaders of this group, about 700 funds. These hedge fund managers administer bulk of all hedge funds’ total capital, and by tracking their highest performing stock picks, Insider Monkey has determined a number of investment strategies that have historically exceeded the broader indices. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by 6 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Cliff Asness of AQR Capital Management

Let’s go over the key hedge fund action regarding LivePerson, Inc. (NASDAQ:LPSN).

How have hedgies been trading LivePerson, Inc. (NASDAQ:LPSN)?

At Q3’s end, a total of 12 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -29% from one quarter earlier. By comparison, 17 hedge funds held shares or bullish call options in LPSN heading into this year. With hedge funds’ capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

Among these funds, RGM Capital held the most valuable stake in LivePerson, Inc. (NASDAQ:LPSN), which was worth $39.8 million at the end of the third quarter. On the second spot was Renaissance Technologies which amassed $39.6 million worth of shares. Moreover, Arrowstreet Capital, AQR Capital Management, and D E Shaw were also bullish on LivePerson, Inc. (NASDAQ:LPSN), allocating a large percentage of their portfolios to this stock.

Judging by the fact that LivePerson, Inc. (NASDAQ:LPSN) has faced falling interest from hedge fund managers, it’s safe to say that there was a specific group of hedge funds that decided to sell off their entire stakes last quarter. At the top of the heap, Ken Griffin’s Citadel Investment Group cut the biggest stake of the 700 funds watched by Insider Monkey, worth about $1.4 million in stock. Gavin Saitowitz and Cisco J. del Valle’s fund, Springbok Capital, also dropped its stock, about $0.6 million worth. These moves are important to note, as aggregate hedge fund interest was cut by 5 funds last quarter.

Let’s go over hedge fund activity in other stocks similar to LivePerson, Inc. (NASDAQ:LPSN). We will take a look at Meritage Homes Corp (NYSE:MTH), Papa John’s International, Inc. (NASDAQ:PZZA), PPDAI Group Inc. (NYSE:PPDF), and TransAlta Corporation (NYSE:TAC). All of these stocks’ market caps are closest to LPSN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MTH | 13 | 223910 | -3 |

| PZZA | 27 | 358846 | 8 |

| PPDF | 5 | 7735 | 0 |

| TAC | 9 | 17973 | 2 |

| Average | 13.5 | 152116 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.5 hedge funds with bullish positions and the average amount invested in these stocks was $152 million. That figure was $129 million in LPSN’s case. Papa John’s International, Inc. (NASDAQ:PZZA) is the most popular stock in this table. On the other hand PPDAI Group Inc. (NYSE:PPDF) is the least popular one with only 5 bullish hedge fund positions. LivePerson, Inc. (NASDAQ:LPSN) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard PZZA might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.