Hedge funds are known to underperform the bull markets but that’s not because they are terrible at stock picking. Hedge funds underperform because their net exposure in only 40-70% and they charge exorbitant fees. No one knows what the future holds and how market participants will react to the bountiful news that floods in each day. However, hedge funds’ consensus picks on average deliver market beating returns. For example the Standard and Poor’s 500 Total Return Index ETFs returned 27.5% (including dividend payments) through the end of November. Conversely, hedge funds’ top 20 large-cap stock picks generated a return of nearly 37.4% during the same period, with the majority of these stock picks outperforming the broader market benchmark. Interestingly, an average long/short hedge fund returned only a fraction of this value due to the hedges they implemented and the large fees they charged. If you pay attention to the actual hedge fund returns versus the returns of their long stock picks, you might believe that it is a waste of time to analyze hedge funds’ purchases. We know better. That’s why we scrutinize hedge fund sentiment before we invest in a stock like Liberty Property Trust (NYSE:LPT).

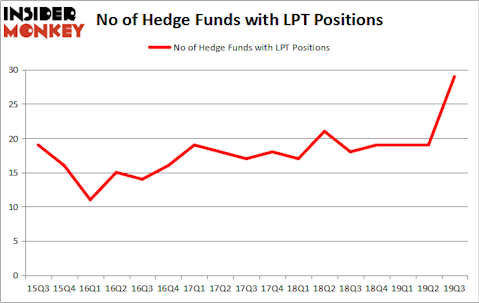

Liberty Property Trust (NYSE:LPT) has seen an increase in hedge fund interest in recent months. Our calculations also showed that LPT isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In today’s marketplace there are plenty of gauges market participants have at their disposal to value stocks. A pair of the most useful gauges are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the elite investment managers can outperform the market by a solid amount (see the details here).

Clint Carlson of Carlson Capital

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to take a gander at the recent hedge fund action surrounding Liberty Property Trust (NYSE:LPT).

What does smart money think about Liberty Property Trust (NYSE:LPT)?

At the end of the third quarter, a total of 29 of the hedge funds tracked by Insider Monkey were long this stock, a change of 53% from one quarter earlier. On the other hand, there were a total of 18 hedge funds with a bullish position in LPT a year ago. With the smart money’s capital changing hands, there exists a select group of noteworthy hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Zimmer Partners, managed by Stuart J. Zimmer, holds the largest position in Liberty Property Trust (NYSE:LPT). Zimmer Partners has a $218.3 million position in the stock, comprising 2.4% of its 13F portfolio. Coming in second is John Khoury of Long Pond Capital, with a $98.9 million position; the fund has 2.6% of its 13F portfolio invested in the stock. Some other professional money managers that are bullish encompass Ken Griffin’s Citadel Investment Group, Jonathan Litt’s Land & Buildings Investment Management and Clint Carlson’s Carlson Capital. In terms of the portfolio weights assigned to each position Shoals Capital Management allocated the biggest weight to Liberty Property Trust (NYSE:LPT), around 9.53% of its portfolio. Land & Buildings Investment Management is also relatively very bullish on the stock, earmarking 8.52 percent of its 13F equity portfolio to LPT.

With a general bullishness amongst the heavyweights, specific money managers were breaking ground themselves. Citadel Investment Group, managed by Ken Griffin, assembled the largest position in Liberty Property Trust (NYSE:LPT). Citadel Investment Group had $55.7 million invested in the company at the end of the quarter. Matthew Halbower’s Pentwater Capital Management also initiated a $12.8 million position during the quarter. The other funds with brand new LPT positions are Benjamin A. Smith’s Laurion Capital Management, Paul Marshall and Ian Wace’s Marshall Wace, and Jeffrey Hinkle’s Shoals Capital Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Liberty Property Trust (NYSE:LPT) but similarly valued. We will take a look at Perrigo Company plc (NYSE:PRGO), ServiceMaster Global Holdings Inc (NYSE:SERV), AptarGroup, Inc. (NYSE:ATR), and AngloGold Ashanti Limited (NYSE:AU). This group of stocks’ market values are closest to LPT’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PRGO | 15 | 453537 | -6 |

| SERV | 26 | 927792 | -4 |

| ATR | 22 | 112361 | 2 |

| AU | 19 | 454469 | 3 |

| Average | 20.5 | 487040 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.5 hedge funds with bullish positions and the average amount invested in these stocks was $487 million. That figure was $576 million in LPT’s case. ServiceMaster Global Holdings Inc (NYSE:SERV) is the most popular stock in this table. On the other hand Perrigo Company plc (NYSE:PRGO) is the least popular one with only 15 bullish hedge fund positions. Compared to these stocks Liberty Property Trust (NYSE:LPT) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on LPT as the stock returned 20% during the first two months of Q4 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.