We at Insider Monkey have gone over 738 13F filings that hedge funds and famous value investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of March 31st. In this article we look at what those investors think of Lattice Semiconductor Corporation (NASDAQ:LSCC).

Is Lattice Semiconductor Corporation (NASDAQ:LSCC) an exceptional stock to buy now? The best stock pickers are buying. The number of long hedge fund bets advanced by 3 in recent months. Our calculations also showed that LSCC isn’t among the 30 most popular stocks among hedge funds.

At the moment there are a large number of methods shareholders have at their disposal to evaluate their holdings. Two of the most useful methods are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the top picks of the top fund managers can outpace the S&P 500 by a very impressive amount (see the details here).

Let’s take a peek at the latest hedge fund action surrounding Lattice Semiconductor Corporation (NASDAQ:LSCC).

How have hedgies been trading Lattice Semiconductor Corporation (NASDAQ:LSCC)?

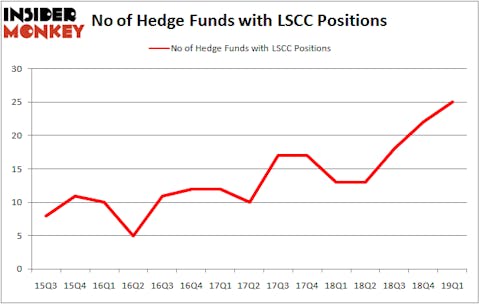

At the end of the first quarter, a total of 25 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 14% from the previous quarter. The graph below displays the number of hedge funds with bullish position in LSCC over the last 15 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Lion Point held the most valuable stake in Lattice Semiconductor Corporation (NASDAQ:LSCC), which was worth $93.7 million at the end of the first quarter. On the second spot was Renaissance Technologies which amassed $20.1 million worth of shares. Moreover, Greenhouse Funds, Cardinal Capital, and Millennium Management were also bullish on Lattice Semiconductor Corporation (NASDAQ:LSCC), allocating a large percentage of their portfolios to this stock.

Consequently, specific money managers have jumped into Lattice Semiconductor Corporation (NASDAQ:LSCC) headfirst. Masters Capital Management, managed by Mike Masters, created the largest position in Lattice Semiconductor Corporation (NASDAQ:LSCC). Masters Capital Management had $11.9 million invested in the company at the end of the quarter. Richard Driehaus’s Driehaus Capital also initiated a $8.9 million position during the quarter. The following funds were also among the new LSCC investors: Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Dipak Patel’s Alight Capital, and Dmitry Balyasny’s Balyasny Asset Management.

Let’s go over hedge fund activity in other stocks similar to Lattice Semiconductor Corporation (NASDAQ:LSCC). These stocks are Pacira BioSciences, Inc. (NASDAQ:PCRX), Warrior Met Coal, Inc. (NYSE:HCC), Federal Signal Corporation (NYSE:FSS), and Redwood Trust, Inc. (NYSE:RWT). All of these stocks’ market caps resemble LSCC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PCRX | 27 | 487640 | 2 |

| HCC | 35 | 479779 | 2 |

| FSS | 20 | 71386 | -2 |

| RWT | 15 | 111479 | 3 |

| Average | 24.25 | 287571 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.25 hedge funds with bullish positions and the average amount invested in these stocks was $288 million. That figure was $245 million in LSCC’s case. Warrior Met Coal, Inc. (NYSE:HCC) is the most popular stock in this table. On the other hand Redwood Trust, Inc. (NYSE:RWT) is the least popular one with only 15 bullish hedge fund positions. Lattice Semiconductor Corporation (NASDAQ:LSCC) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on LSCC as the stock returned 3.5% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.