Is Lattice Semiconductor Corporation (NASDAQ:LSCC) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

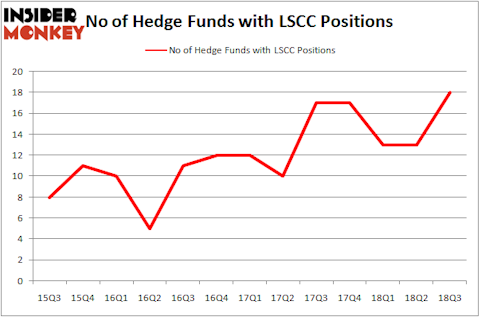

Lattice Semiconductor Corporation (NASDAQ:LSCC) was in 18 hedge funds’ portfolios at the end of September. LSCC investors should be aware of an increase in support from the world’s most elite money managers lately. There were 13 hedge funds in our database with LSCC positions at the end of the previous quarter. Our calculations also showed that LSCC isn’t among the 30 most popular stocks among hedge funds.

According to most stock holders, hedge funds are viewed as underperforming, old financial vehicles of years past. While there are greater than 8,000 funds with their doors open at the moment, Our experts hone in on the leaders of this club, approximately 700 funds. Most estimates calculate that this group of people manage the lion’s share of the smart money’s total capital, and by monitoring their inimitable investments, Insider Monkey has revealed a few investment strategies that have historically outperformed the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outrun the S&P 500 index by 6 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Let’s check out the latest hedge fund action surrounding Lattice Semiconductor Corporation (NASDAQ:LSCC).

What have hedge funds been doing with Lattice Semiconductor Corporation (NASDAQ:LSCC)?

At the end of the third quarter, a total of 18 of the hedge funds tracked by Insider Monkey were long this stock, a change of 38% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards LSCC over the last 13 quarters. With hedge funds’ sentiment swirling, there exists a select group of noteworthy hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

Among these funds, Lion Point held the most valuable stake in Lattice Semiconductor Corporation (NASDAQ:LSCC), which was worth $68.7 million at the end of the third quarter. On the second spot was Greenhouse Funds which amassed $26.2 million worth of shares. Moreover, Cardinal Capital, Millennium Management, and Renaissance Technologies were also bullish on Lattice Semiconductor Corporation (NASDAQ:LSCC), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, key money managers have been driving this bullishness. Cardinal Capital, managed by Amy Minella, initiated the most valuable position in Lattice Semiconductor Corporation (NASDAQ:LSCC). Cardinal Capital had $23.8 million invested in the company at the end of the quarter. Jim Simons’s Renaissance Technologies also initiated a $4.1 million position during the quarter. The other funds with brand new LSCC positions are Mark Kingdon’s Kingdon Capital, Joel Greenblatt’s Gotham Asset Management, and Paul Tudor Jones’s Tudor Investment Corp.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Lattice Semiconductor Corporation (NASDAQ:LSCC) but similarly valued. We will take a look at PetIQ, Inc. (NASDAQ:PETQ), Super Micro Computer, Inc. (NASDAQ:SMCI), AllianceBernstein Global High Income Fund (NYSE:AWF), and Golar LNG Partners LP (NASDAQ:GMLP). This group of stocks’ market caps match LSCC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PETQ | 22 | 106182 | 9 |

| SMCI | 3 | 58886 | -7 |

| AWF | 1 | 1850 | -2 |

| GMLP | 6 | 36721 | 2 |

| Average | 8 | 50910 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8 hedge funds with bullish positions and the average amount invested in these stocks was $51 million. That figure was $161 million in LSCC’s case. PetIQ, Inc. (NASDAQ:PETQ) is the most popular stock in this table. On the other hand AllianceBernstein Global High Income Fund (NYSE:AWF) is the least popular one with only 1 bullish hedge fund positions. Lattice Semiconductor Corporation (NASDAQ:LSCC) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard PETQ might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.