The elite funds run by legendary investors such as David Tepper and Dan Loeb make hundreds of millions of dollars for themselves and their investors by spending enormous resources doing research on small cap stocks that big investment banks don’t follow. Because of their pay structures, they have strong incentives to do the research necessary to beat the market. That’s why we pay close attention to what they think in small cap stocks. In this article, we take a closer look at Kornit Digital Ltd. (NASDAQ:KRNT) from the perspective of those elite funds.

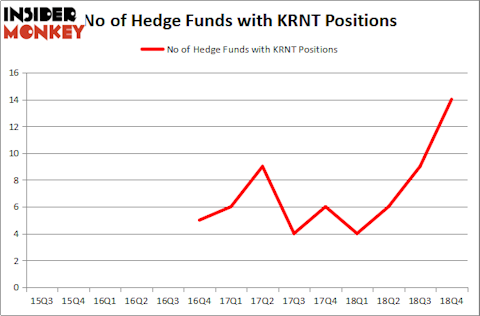

Kornit Digital Ltd. (NASDAQ:KRNT) investors should be aware of an increase in enthusiasm from smart money lately. KRNT was in 14 hedge funds’ portfolios at the end of December. There were 9 hedge funds in our database with KRNT positions at the end of the previous quarter. Our calculations also showed that KRNT isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to analyze the key hedge fund action regarding Kornit Digital Ltd. (NASDAQ:KRNT).

What does the smart money think about Kornit Digital Ltd. (NASDAQ:KRNT)?

Heading into the first quarter of 2019, a total of 14 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 56% from one quarter earlier. On the other hand, there were a total of 4 hedge funds with a bullish position in KRNT a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Kornit Digital Ltd. (NASDAQ:KRNT) was held by Driehaus Capital, which reported holding $12.2 million worth of stock at the end of December. It was followed by Royce & Associates with a $10.8 million position. Other investors bullish on the company included Rima Senvest Management, Laurion Capital Management, and Deep Field Asset Management.

As aggregate interest increased, specific money managers were breaking ground themselves. Laurion Capital Management, managed by Benjamin A. Smith, created the biggest position in Kornit Digital Ltd. (NASDAQ:KRNT). Laurion Capital Management had $5 million invested in the company at the end of the quarter. Jordan Moelis and Jeff Farroni’s Deep Field Asset Management also made a $3.4 million investment in the stock during the quarter. The following funds were also among the new KRNT investors: Alec Litowitz and Ross Laser’s Magnetar Capital, David Costen Haley’s HBK Investments, and Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Kornit Digital Ltd. (NASDAQ:KRNT) but similarly valued. These stocks are Valhi, Inc. (NYSE:VHI), Vista Outdoor Inc (NYSE:VSTO), Principia Biopharma Inc. (NASDAQ:PRNB), and Cohu, Inc. (NASDAQ:COHU). This group of stocks’ market values are closest to KRNT’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VHI | 9 | 4014 | -1 |

| VSTO | 14 | 56303 | -5 |

| PRNB | 12 | 212554 | -3 |

| COHU | 9 | 33677 | -6 |

| Average | 11 | 76637 | -3.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11 hedge funds with bullish positions and the average amount invested in these stocks was $77 million. That figure was $51 million in KRNT’s case. Vista Outdoor Inc (NYSE:VSTO) is the most popular stock in this table. On the other hand Valhi, Inc. (NYSE:VHI) is the least popular one with only 9 bullish hedge fund positions. Kornit Digital Ltd. (NASDAQ:KRNT) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on KRNT as the stock returned 48.2% and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.