Amid an overall bull market, many stocks that smart money investors were collectively bullish on surged through October 17th. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 45% and 39% respectively. Our research shows that most of the stocks that smart money likes historically generate strong risk-adjusted returns. That’s why we weren’t surprised when hedge funds’ top 20 large-cap stock picks generated a return of 24.4% during the first 9 months of 2019 and outperformed the broader market benchmark by 4 percentage points.This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

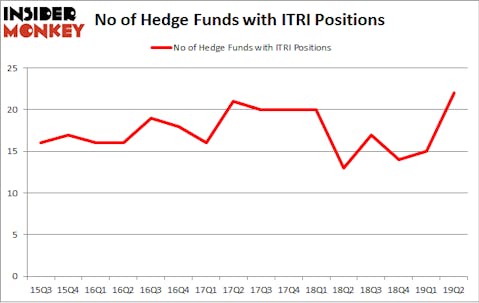

Itron, Inc. (NASDAQ:ITRI) was in 22 hedge funds’ portfolios at the end of the second quarter of 2019. ITRI investors should be aware of an increase in hedge fund interest of late. There were 15 hedge funds in our database with ITRI holdings at the end of the previous quarter. Our calculations also showed that ITRI isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

If you’d ask most market participants, hedge funds are viewed as slow, old financial vehicles of the past. While there are over 8000 funds in operation at the moment, Our experts look at the aristocrats of this group, about 750 funds. These hedge fund managers control bulk of the hedge fund industry’s total capital, and by following their inimitable stock picks, Insider Monkey has unsheathed many investment strategies that have historically surpassed Mr. Market. Insider Monkey’s flagship hedge fund strategy outrun the S&P 500 index by around 5 percentage points per annum since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a look at the latest hedge fund action surrounding Itron, Inc. (NASDAQ:ITRI).

How are hedge funds trading Itron, Inc. (NASDAQ:ITRI)?

Heading into the third quarter of 2019, a total of 22 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 47% from the first quarter of 2019. By comparison, 13 hedge funds held shares or bullish call options in ITRI a year ago. With the smart money’s sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were adding to their stakes substantially (or already accumulated large positions).

The largest stake in Itron, Inc. (NASDAQ:ITRI) was held by Scopia Capital, which reported holding $204 million worth of stock at the end of March. It was followed by Impax Asset Management with a $146.2 million position. Other investors bullish on the company included Cardinal Capital, Millennium Management, and Citadel Investment Group.

As industrywide interest jumped, some big names have been driving this bullishness. Driehaus Capital, managed by Richard Driehaus, established the biggest position in Itron, Inc. (NASDAQ:ITRI). Driehaus Capital had $3.8 million invested in the company at the end of the quarter. Noam Gottesman’s GLG Partners also made a $2.3 million investment in the stock during the quarter. The following funds were also among the new ITRI investors: John Overdeck and David Siegel’s Two Sigma Advisors, D. E. Shaw’s D E Shaw, and Bernard Lambilliotte’s Ecofin Ltd.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Itron, Inc. (NASDAQ:ITRI) but similarly valued. These stocks are Wolverine World Wide, Inc. (NYSE:WWW), World Fuel Services Corporation (NYSE:INT), PolyOne Corporation (NYSE:POL), and Independent Bank Group Inc (NASDAQ:IBTX). This group of stocks’ market caps are closest to ITRI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WWW | 12 | 49072 | -7 |

| INT | 19 | 149964 | 1 |

| POL | 24 | 224406 | 1 |

| IBTX | 9 | 95311 | -1 |

| Average | 16 | 129688 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16 hedge funds with bullish positions and the average amount invested in these stocks was $130 million. That figure was $483 million in ITRI’s case. PolyOne Corporation (NYSE:POL) is the most popular stock in this table. On the other hand Independent Bank Group Inc (NASDAQ:IBTX) is the least popular one with only 9 bullish hedge fund positions. Itron, Inc. (NASDAQ:ITRI) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on ITRI as the stock returned 18.2% during the third quarter and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.